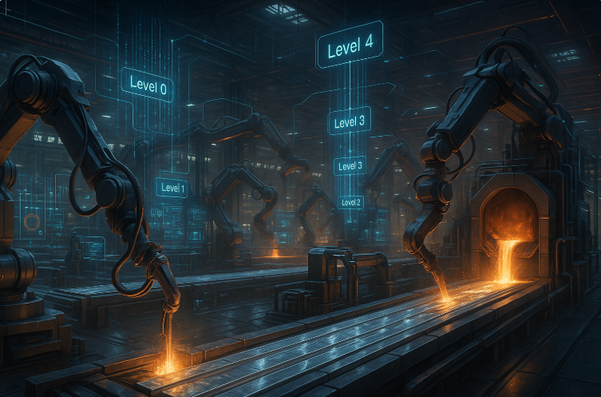

Overview of ISA-95 Architecture

ISA-95 Levels 0–4: ISA-95 (IEC 62264) is an international standard for integrating enterprise and control systems[1]. It defines five functional levels (sometimes visualized as a pyramid) that separate concerns from the physical process up to business planning[2][2]:

- Level 0 – Physical Process: This is the production floor itself – the physical machines, equipment, and devices that carry out manufacturing. It includes sensors (temperature, pressure, proximity, etc.), actuators (motors, valves), robots, conveyors, furnaces, and all other hardware that directly touches the product or process. These devices gather real-time data and execute actions in the process[3]. For example, in a steel mill, Level 0 encompasses the rolling mill motors, temperature probes in a furnace, or weighing scales on a conveyor.

- Level 1 – Basic Control: This level comprises the automatic control of individual machines or units. Programmable Logic Controllers (PLCs), Distributed Control Systems (DCS) controllers, and embedded controllers reside here, along with local operator interface panels. They receive inputs from Level 0 sensors and send commands to actuators, running predefined logic to control each machine in real time[3]. A PLC at Level 1 might regulate a pump’s speed based on a pressure sensor or maintain a furnace temperature by opening/closing a gas valve.

- Level 2 – Supervisory Control (SCADA & HMIs): Level 2 includes supervisory systems that coordinate multiple control devices and provide human operators with plant-wide visualization and alarms. This typically involves SCADA (Supervisory Control and Data Acquisition) software, operator Human-Machine Interfaces (HMIs), and data historians that log process data[3]. Level 2 systems collect data from many PLCs, display real-time status on control room screens, and execute supervisory control strategies (e.g. adjusting setpoints). They often handle quality control checks and reporting at the process level[3]. For instance, a SCADA system might oversee an entire production line, aggregating data from all Level 1 controllers and alerting if any parameter goes out of range.

- Level 3 – Manufacturing Operations Management (MES/MOM): This is the manufacturing execution layer that bridges the plant floor and business systems. Level 3 includes MES (Manufacturing Execution Systems) or MOM (Manufacturing Operations Management) software responsible for production scheduling, dispatching work orders, tracking material and inventory within the plant, recording production results, managing quality procedures, and coordinating maintenance activities[3][3]. In practice, an MES at Level 3 takes orders from ERP (Level 4) and orchestrates their execution on the shop floor, monitoring progress and performance. It ensures the right materials and instructions are delivered to production, collects data on output, downtime, and quality, and provides feedback to both operators and higher-level systems[3][3]. For example, the MES might schedule a steel rolling mill’s daily production, track each batch of steel, record quality measurements, and issue maintenance work orders if a pattern of faults is detected.

- Level 4 – Business Planning & Logistics: The top level of ISA-95 consists of enterprise systems that handle business-wide logistics, planning, and administration. This typically means an ERP (Enterprise Resource Planning) system alongside related corporate IT systems (financials, sales and CRM, supply chain management, HR, etc.). Level 4 systems plan production based on demand, manage purchasing and supply chain, track customer orders and shipments, and handle all the finance and accounting for the business[2]. These systems operate on aggregated data and longer time horizons (hours to months) rather than real-time seconds. For instance, an ERP will generate a Master Production Schedule and procurement plan, which the MES (Level 3) will execute in detail. The ERP also receives production results (quantities made, material consumed) from MES to update inventory and costing in financial ledgers[3][3].

Integration & Best Practices: In a well-designed ISA-95 architecture, each level focuses on its core functions but shares data with adjacent levels through defined interfaces[1]. Best practices for system selection and integration across levels include:

- Clear Interface Definitions: Adopt standard data models and communication standards for IT/OT integration. ISA-95 itself provides models for the information exchanged between Level 4 and Level 3 (like production schedules, material consumption, equipment status) to reduce integration cost and errors[1]. Using protocols like OPC UA for shop-floor data, MQTT or REST APIs, and standardized tags/naming conventions helps ensure systems can interoperate without custom one-off links.

- Separation of Concerns with Data Flow: Real-time control should remain at Level 1–2 (on-premises, close to the equipment) for safety and speed, while high-level planning and analytics reside at Level 3–4 (often in enterprise datacenters or cloud)[3][3]. This prevents overloading business systems with minute-by-minute data and preserves the reliability of plant controls. For example, a best practice is to have Level 2 historians or middleware aggregate raw sensor readings to a meaningful interval or event before sending to ERP/MES, rather than trying to pump every millisecond reading into the ERP[4][4]. Edge computing or on-premise gateways can preprocess data and act as buffers to the cloud, ensuring only relevant information is exchanged and that critical control can continue even if the network is down[4][4].

- Master Data Consistency: Ensure that foundational data (equipment IDs, product codes, batch numbers, etc.) is unified across systems. A common practice is to have the ERP or a master data management system govern identifiers, which MES and SCADA use to tag data. This way, a “Product X” or “Heat #1001” is recognized at all levels. It facilitates end-to-end traceability – e.g. from a raw material lot in ERP to the process parameters in MES to the sensor readings in SCADA – all linked by consistent IDs[3][3]. Standards like ISA-95 provide an equipment hierarchy and object models that help map how a piece of equipment or a material lot is represented at each level, aiding consistency.

- Interoperability and Modular Selection: When selecting systems for each level, consider vendors that support open interfaces and avoid proprietary data lock-in. For instance, if choosing a Level 3 MES, ensure it has connectors or APIs to communicate with your Level 2 control systems and Level 4 ERP. Many large vendors provide pre-built integrations (like Siemens MES to SAP ERP) – these can accelerate projects but often come at high licensing cost[3][3]. An alternative best practice, especially for cost-sensitive situations, is to use open-source or open-architecture platforms where possible, and invest in custom integration tailored to your process. The trade-off is between upfront cost and flexibility: proprietary stacks may plug-and-play more easily, whereas a mix-and-match approach (e.g. open-source ERP with a specialized control system) can be more cost-effective but requires integration effort[3][3]. In either case, aligning to ISA-95 models ensures that even custom integrations follow a common structure (for example, implementing the standard transactions for “Work Order Send” or “Production Performance” between ERP and MES as defined in ISA-95 Part 5)[1].

- Performance and Latency Considerations: Design the architecture such that the latency and volume of data are appropriate to each level’s needs. Level 1 and 2 systems often run on sub-second cycles and must not depend on wide-area networks or cloud connectivity for control decisions. Thus, keep control loops local. Higher-level systems (MES/ERP) can operate on minutes or hours timescales and can be cloud-hosted or centralized. However, they should receive timely updates: a rule of thumb is that MES should know production events in near-real-time (within seconds to a minute) to be effective. Using message brokers (MQTT, Kafka, etc.) or industrial middleware can help buffer and stream data reliably upward, while also pushing instructions downward when needed[4][4]. Edge agents can serve as intermediaries – for example, an on-premise PC at the plant might subscribe to real-time PLC data, filter and package it, then forward it to cloud ERP/MES via secure APIs[4][4]. This kind of design (sometimes called hybrid cloud or fog computing) is increasingly a best practice to get the best of both worlds: local resilience and cloud scalability.

- Security and Access Control: Integrating across levels means formerly isolated operational technology (OT) networks may connect to IT networks and the internet. Best practice is to follow IEC-62443 and Purdue Model zone/conduit principles for security: strictly firewall and segment the plant floor networks, use demilitarized zones (DMZ) for any connections between Level 3 and Level 4, and enforce authentication and encryption for data transfer. Role-based access control should be implemented so that, for instance, an engineer in Level 2 can send data up, but a corporate user at Level 4 cannot accidentally (or maliciously) send unauthorized commands down to a PLC. Selecting systems that support modern security (TLS encryption, user access controls, audit trails) and keeping them updated is crucial as integration expands the threat surface.

- Data Governance and Ownership: With data flowing from shop floor sensors to cloud analytics, companies need clear governance on who manages this data and how it’s used. Define data ownership for each level’s data (e.g. process engineers “own” the SCADA historian data, IT owns the ERP data) but also establish cross-functional data teams to ensure the data is interpretable across domains. Practically, this could mean ensuring that MES events and ERP events use the same timestamp standards, units of measure conversions are handled (metric vs imperial), and context is preserved (e.g. MES sending not just a value but what it represents, like “Temperature of Tank A in °C”). Good governance also involves cleaning and maintaining the data – for instance, avoiding duplicate entries (a machine shouldn’t be known by two different names in MES vs ERP) and validating data flows (check that every production order sent to MES was executed and reported back). Adopting ISA-95’s standard terminology and object models can guide what data to exchange and how to structure it[1][1], thereby improving semantic alignment between levels.

Typical Systems by Level: The following table summarizes typical systems or vendor solutions found at each ISA-95 level (these can vary by industry):

| ISA-95 Level | Scope & Examples of Systems |

| Level 0 (Field Devices) | Physical process devices: sensors (e.g. thermocouples, pressure transducers), actuators (motors, valves, relays), instrumentation, robots, machine tools, conveyors, pumps, furnaces. Example: Temperature sensors and flow meters on a chemical reactor; robotic arms on an assembly line. |

| Level 1 (Basic Control) | Control devices that directly interface with Level 0: PLCs (Siemens S7, Allen-Bradley ControlLogix), DCS controllers (Honeywell Experion, Emerson DeltaV for process control), embedded microcontrollers. Also local HMIs on machines. Example: A PLC controlling a packaging machine or a DCS regulating an oil refinery unit; operators have a local touchscreen to start/stop the machine. |

| Level 2 (Supervisory Control & Data Acquisition) | SCADA software platforms (Aveva Wonderware, Ignition by Inductive Automation, GE iFIX, Siemens WinCC) and distributed HMI systems for plant oversight. Data historians (OSIsoft PI, Aveva Historian, AspenTech IP21) store time-series process data. Batch control systems, if applicable, reside here. Example: A SCADA system aggregating data from all factory PLCs to show a real-time production dashboard; historian logs every process variable every minute for analysis. |

| Level 3 (Manufacturing Operations / MES) | MES/MOM systems that manage operations: production scheduling and tracking (e.g. Siemens Opcenter, Rockwell FactoryTalk MES, Dassault Apriso), quality management systems (could be modules of MES or standalone), plant maintenance management (IBM Maximo, SAP PM, or specialized CMMS), inventory and warehouse management for WIP materials, and production reporting tools. Sometimes custom in-house MES or extensions of ERP are used. Example: A steel plant’s MES schedules each stage of steelmaking and rolling, tracks each batch’s composition and downtime events, and interfaces with lab systems for quality results. |

| Level 4 (Enterprise / ERP) | ERP and corporate IT systems: SAP S/4HANA, Oracle ERP Cloud, Microsoft Dynamics 365, ERPNext (open-source), etc., handling enterprise-wide processes – order management, procurement, inventory, finance, HR. Also supply chain management (APS systems, supply planning tools), CRM for sales, and business intelligence analytics. Example: An ERP that takes customer orders, plans production quantities for the week, orders raw materials, and after production, receives actual output numbers and consumption from MES to do invoicing and cost accounting. |

Selecting the right system at each level depends on company size, industry, and existing infrastructure. Large enterprises often opt for proven commercial solutions at Level 3 and 4 (e.g. MES from industry-specific vendors, ERP from SAP/Oracle) to ensure support and reliability. Smaller firms or those in constrained environments may choose open-source or lightweight solutions (like ERPNext for ERP, or even Excel/Access-based tools at MES level) to minimize costs[3][3]. What’s critical is that all these systems are integrated following the ISA-95 framework so that data flows smoothly from sensor to CFO: production data captured on the shop floor should inform business decisions, and business requirements should automatically guide shop floor actions, with minimal manual transcribing between systems[3][3].

Case Study 1 – Emirates Global Aluminium (EGA)

Overview of EGA’s Operations: Emirates Global Aluminium (EGA) is the UAE’s largest industrial company outside oil & gas, and a leading ‘premium aluminium’ producer[5]. EGA’s value chain spans from bauxite mining (raw aluminum ore) to alumina refining and finally aluminium smelting. In Guinea (West Africa), EGA operates bauxite mines; the ore is shipped to the UAE, where EGA’s Al Taweelah Alumina Refinery processes bauxite into alumina (aluminum oxide) via the Bayer process. The alumina is then fed into massive smelters at EGA’s sites (Jebel Ali and Al Taweelah) where electrolytic reduction cells (potlines) use the Hall-Héroult process to smelt alumina into molten aluminium. The molten aluminium is cast into various products (ingots, billets, etc.) for export. This end-to-end process (bauxite → alumina → aluminium) is highly energy-intensive and technologically sophisticated, with EGA producing ~4% of the world’s aluminium and employing over 7,000 people[6].

Systems Mapped to ISA-95 Levels: EGA has invested heavily in both proprietary and cutting-edge digital systems across all ISA-95 levels to run and optimize this process:

- Level 0–1 (Process Devices & Basic Control): EGA’s smelter pots and refinery equipment are instrumented with thousands of sensors and actuators. Each smelting pot (where alumina is reduced to aluminium metal) is essentially an electrochemical reactor requiring tight control. EGA developed an in-house Pot Control System (PCS) that embeds advanced control algorithms into the potlines[5]. The PCS consists of PLCs and specialized controllers at each pot or group of pots, reading data like voltage, temperature, and alumina feed rates, and actuating components (feeding alumina, adjusting current, etc.) to optimize the smelting reaction. This PCS is proprietary “smart” software integrated with the physical pot hardware[5]. It aims to improve energy efficiency and reduce environmental impact – for example, by minimizing “anode effects” (an undesirable condition in aluminium pots that leads to greenhouse gas spikes). By controlling the process in real-time, EGA’s Level 1 systems keep the electrolytic cells stable and efficient. Similarly, in the alumina refinery, distributed control systems (DCS) regulate digestion, precipitation and calcination steps.

- Level 2 (Supervisory Control & Plant Monitoring): At the smelter and refinery operations, EGA employs comprehensive SCADA and HMI systems for operators. There are control rooms where engineers monitor the entire potline status on large screens, view trends from thousands of sensors, and get alarm notifications if any parameter deviates. A plant-wide historian database logs process data (temperatures, voltages, feed rates, etc.) at high frequency. EGA’s SCADA likely integrates with the PCS controllers; for example, if the PCS detects an anomaly in a pot, it would alert SCADA, which in turn alarms the operators. Additionally, EGA’s power plant and utilities (since smelters have dedicated power stations) have their own control systems but report key metrics to the central SCADA. An example of SCADA integration is the Vista Automation project for EGA’s EMAL smelter, which achieved a plant-wide SCADA system for 1.4 million ton/year production[7]. The SCADA/Level 2 layer at EGA not only supervises process control but also handles routine automation like starting/stopping equipment sequences, compiling shift reports, and implementing safety interlocks across the plant.

- Level 3 (Manufacturing Operations / MES): Rather than using an off-the-shelf MES, EGA has built a Digital Manufacturing Platform as part of its Industry 4.0 initiative[8][8]. Launched in 2024 in collaboration with Microsoft, this platform is one of the region’s first and is a foundational layer for EGA’s operations. It processes an enormous volume of real-time plant data – over 2.9 petabytes per year – and knits together hardware, software, processes, and people across EGA’s global operations[8][8]. Essentially, this digital platform serves as EGA’s MES/MOM: it integrates with the potline control systems and SCADA (Level 1–2), ingesting process data, and also interfaces up to the business systems (Level 4). Its responsibilities include production tracking, advanced process analytics, quality control, maintenance management, and more. EGA branded this as a “Digital Manufacturing Platform” to emphasize its modern, AI-enabled approach (more on the AI shortly). The platform was built using Microsoft Azure’s hybrid cloud architecture, indicating some components run on-premises at plants (for low latency) while others run in Azure cloud[8]. It leverages Azure’s Adaptive Cloud framework, previously used in defense and space, to combine on-site and cloud computing for OT data[8].

- In practice, when a potline is running, the Digital Manufacturing Platform (Level 3) is continuously receiving streams of data from SCADA and PCS, analyzing them for trends or issues, and perhaps optimizing operations like adjusting setpoints or scheduling anodes replacement. It also handles production scheduling and coordination: for example, planning the sequence of casting operations or timing when to process each batch of alumina, based on orders from the ERP. By having a unified digital MES, EGA ensures that all plants (smelters, refinery, power plant, port operations) are connected. The platform has reportedly allowed EGA to cut the cost of running AI-driven analyses by 80% and improved AI response times 13-fold compared to prior setups[8] – evidence of how integrating MES data with cloud computing yielded performance gains. It currently hosts dozens of digital use-cases – in 2022 alone EGA rolled out nearly 40 new “digital applications” on this platform (analytics apps, dashboards, decision support tools), generating over $25 million in value[5].

- EGA’s approach exemplifies a modern MES: rather than a monolithic software, it’s a platform where various Industry 4.0 applications plug in, all fed by real-time shop floor data and feeding back instructions. They have a dedicated digital team (with an Industry 4.0 Center of Excellence and a “digital factory” for rapid development) that has delivered 80+ use cases as of 2024[6] – from AI vision systems to digital twins for logistics. This platform-centric MES is a key for EGA to become a WEF “Manufacturing Lighthouse”, an accolade EGA achieved in 2024 as the world’s first aluminium company recognized for scaling Industry 4.0 tech globally[9][6].

- Level 4 (Enterprise Planning & Business Systems): At the enterprise level, EGA relies on SAP for its core ERP. In 2024 EGA decided to upgrade to SAP S/4HANA as part of its digital transformation[10]. The new ERP is hosted in a private cloud on Microsoft Azure via RISE with SAP[10], aligning with EGA’s cloud-first strategy. SAP at EGA covers end-to-end business functions: marketing & sales, supply chain management, finance and controlling, human capital management, production planning, maintenance planning, procurement – essentially all corporate processes are managed in SAP[10]. Before the upgrade, EGA was already using an older SAP ERP; the move to S/4HANA aimed to boost processing speeds (30× faster analytics), provide a modern user experience (real-time, mobile-friendly interfaces), and unlock easier integration with advanced digital tools (AI and analytics)[10][10].

- With SAP S/4HANA on Azure, EGA’s ERP (Level 4) is tightly integrated with the Level 3 digital manufacturing platform. The Chief Digital Officer noted that S/4HANA “integrates seamlessly to our state-of-the-art data platform which enables a wide range of Industry 4.0 capabilities”[10]. For example, when a customer order is received (handled in SAP’s Sales module), the ERP triggers production requirements that are sent down to the manufacturing platform as planned orders or work orders. As production progresses, the MES/digital platform streams back actual production data to SAP: finished goods quantities, production timestamps, quality results, etc. This keeps the ERP’s inventory and order status up-to-date in near real time[3][3]. SAP is also used for maintenance management at EGA (recording equipment, scheduling PMs), but the digital platform likely augments this with real-time condition data and predictive maintenance insights which then reflect in SAP’s Plant Maintenance module.

- EGA’s ERP upgrade was part of a broader push that by 2024 delivered over 60 Industry 4.0 use cases and upskilled almost 2,000 employees in digital skills[10]. By mid-2025, the impact grew to 80+ use cases and 3,000+ staff trained[6][6], emphasizing how crucial change management and employee capability are in such integration (more on that below). In summary, at Level 4 EGA uses a top-tier ERP (SAP S/4HANA) to run the business, connected via Azure cloud to a powerful MES/data platform at Level 3, and down through SCADA and control systems at Levels 1–2 – achieving a full vertical integration of data from potline sensor to corporate financial ledger.

Rationale for System Choices & Integration Approach: EGA’s selection of systems reflects its scale and ambition:

- Proprietary Control (PCS) at Level 0–1: EGA’s core process (smelting) is highly specialized, and EGA has a legacy of developing its own smelting technologies (DX series, now “EX” next-gen cells)[5]. The in-house Pot Control System aligns with this ethos – it’s tailored to EGA’s unique cell designs and operating philosophy. By owning the PCS technology, EGA can innovate for efficiency (e.g. tweaking algorithms to cut energy per ton of aluminium) and keep trade secrets in-house. Also, older commercial solutions might not have met EGA’s needs for scale (EGA’s potlines are enormous) or integration with their R&D improvements. Integration-wise, the PCS likely exposes data to SCADA via standard industrial protocols (perhaps Modbus, OPC, or API connectors), so that the supervisory and MES layers can read pot performance and send high-level commands (like changing a setpoint). Keeping the pot control mostly local ensures safety – if network links fail, each potline PLC can still run autonomously.

- MES Digital Platform vs Traditional MES: EGA could have implemented a commercial MES, but it opted for building a custom platform on Azure. This decision was likely driven by the need for AI and big data analytics at scale. Off-the-shelf MES products often focus on execution and tracking, but EGA wanted a system that could also host AI models (for predictive maintenance, computer vision, etc.) across billions of data points[8][8]. Azure’s cloud tools (data lakes, machine learning services) integrated with a custom MES give EGA the flexibility to develop and iterate digital solutions rapidly (as evidenced by their digital factory producing use cases in “waves” every quarter[6]). Additionally, EGA operates multiple sites (UAE smelters, Guinea mine, etc.), and a cloud-based platform can unify operations data from all locations. The hybrid cloud architecture is key: certain critical applications run on-site (for low latency and to assure operation if the cloud link is down) while heavy data crunching runs in Azure[8]. Microsoft’s involvement suggests that advanced services (like IoT Edge, AI cognitive services) are used. Integration and data governance are handled by building a “digital backbone” – EGA’s platform likely ingests data from SCADA via secure pipelines (possibly MQTT or OPC UA integration to Azure IoT Hub, for example) and stores it in a central data lake. They have also structured governance through a center of excellence and new “ways of working” like agile and data democratization[6][6]. This means data from operations is accessible to employees through self-service tools, but with rules in place about data quality and usage. The outcome is a company-wide data environment where shop-floor data is no longer siloed – it’s available for finance or marketing if needed, and vice versa, ERP data (like sales forecasts) is available to operations for AI models.

- SAP ERP at Level 4: SAP was a natural choice given EGA’s size and global reach. It had already been using SAP ECC (the older ERP) and needed to modernize. SAP S/4HANA on Azure gives EGA a scalable, continuously updated backbone for all business processes[10][10]. The performance gains (30× faster queries) mean that huge datasets (e.g. years of production and financial data) can be analyzed quickly, supporting real-time analytics and AI. SAP also brings best-practice business processes which EGA can align with as it transforms. The RISE with SAP private cloud model offloads a lot of IT maintenance (SAP manages the infrastructure on Azure), allowing EGA’s IT/Digital team to focus on innovation instead of just keeping servers running. Integration-wise, SAP provides standard integration technologies (IDoc, BAPIs, OData services) which likely interface with the digital manufacturing platform. For example, when a production order is created in S/4HANA, a message can be sent to the MES platform (Level 3) via an API or message bus, where it’s executed; as completion confirmations come back, SAP updates inventory and financials[3][3]. EGA’s IT landscape probably also includes SAP modules like APO or IBP for advanced planning, and these would benefit from the rich real-time data coming from operations. By selecting SAP and integrating it tightly, EGA ensures that high-level plans reflect ground truth and vice versa – a core ISA-95 objective.

- Data Governance: EGA handles vast amounts of data (the platform processes petabytes[8]). They instituted robust governance: one of the transformation foundations was “governance and ways of working, including a transition to agile at scale”[6]. They also built a new data platform that “democratizes data” across the company[6]. This indicates that EGA likely implemented a unified data lake or warehouse that pulls in both OT and IT data, with tools for employees to access it (with proper permissions). Governing this means managing data quality (ensuring those petabytes are accurate and timely), security (deciding who can see sensitive production vs financial data), and lifecycle (data archiving policies, etc.). EGA’s partnership with McKinsey’s QuantumBlack suggests they applied advanced data engineering and AI governance – possibly setting up model governance for AI algorithms, version control for analytics, and training programs for staff to utilize data. Indeed, EGA upskilled thousands of employees via a “digital academy”[6] – which not only helps adoption but also instills data-driven culture so that the integration actually yields value (people trust and use the systems).

AI Adoption in EGA’s Industry 4.0 Strategy: EGA has been a frontrunner in applying AI in heavy industry. Within its digital use cases (65+ Industry 4.0 applications so far[11]), several leverage AI for predictive, optimization, and automation purposes:

- Predictive Maintenance: EGA uses machine learning to predict equipment failures before they happen. For example, the pot control systems and sensors generate signals that an AI model can analyze for anomalies (like subtle voltage fluctuations that precede an anode effect or pot failure). By integrating these models with maintenance systems, EGA can schedule maintenance proactively. EGA’s CDO mentioned real-time IoT sensor monitoring enabling AI to “predict maintenance needs before failures occur” with proactive maintenance minimizing downtime[12][12]. They likely have ML models for critical assets like turbines in their power plant, cranes, and casting machines. When the AI model forecasts an issue, it can create a Maintenance Order in SAP or alert engineers via the MES[12][12]. This has reduced unexpected breakdowns and improved asset availability.

- Energy Optimization: Smelting is extremely energy-heavy (aluminium smelting is essentially consuming electricity to break oxygen bonds). Even minor efficiency gains save millions in power costs. EGA has AI initiatives to optimize energy usage per tonne of aluminium. For instance, an AI agent might analyze how tweaking the electrical current or alumina feed rate can reduce power consumption without affecting output, and recommend optimal setpoints[3]. EGA’s next-gen “EX” smelting technology explicitly aims for low emissions and self-optimization using AI[5]. Moreover, EGA’s digital platform likely monitors energy usage in real-time across operations (including the captive power plant) and may use AI to balance loads or reduce peak demand. According to industry reports, AI can help aluminum smelters adjust parameters to cut energy per unit by several percent[13]. EGA’s effort to become a “digital lighthouse” also ties to sustainability – they introduced solar-powered aluminium (CelestiAL) and want to further reduce energy and GHG per tonne[5]. AI is a tool in this by analyzing patterns that humans can’t easily see, such as the relationship between ambient conditions or feed impurities and energy draw, to optimize accordingly.

- Computer Vision & Safety: EGA has deployed AI-driven computer vision in multiple areas. One cited use case is using AI vision to quality-check carbon anodes in real time[10]. Carbon anodes are critical consumables in smelting; defects in anodes can cause inefficiency or contamination. EGA’s vision system likely uses cameras to inspect each anode for cracks or composition issues as they are baked, and automatically rejects or flags substandard ones, ensuring only good anodes go into pots. Additionally, EGA uses video analytics for safety and SOP compliance: as part of their transformation, they implemented “video-based SOP compliance monitoring with real-time notifications to operators and control rooms,” which cut operator response time to alarms by 92% and improved procedure compliance by 65%[6]. In practice, this could be an AI system watching a live camera feed of, say, a potline or casting station, verifying that operators follow safety steps (like wearing PPE or executing steps in order). If someone deviates from standard procedure or an unsafe condition is detected (e.g. a person too close to a robot or not wearing a helmet), the system instantly notifies the operator or remote supervisors[4][4]. This real-time computer vision alerting greatly enhances safety in such a hazardous environment. It’s likely EGA also uses AI cameras for perimeter security and intrusion detection at the plants, similar to how AI CCTV can detect unauthorized entries and alert security[4]. All these AI vision systems tie into EGA’s central platforms – alerts might come through integrated channels (for instance, an automatic message in a “Clefincode Chat” or similar collaboration tool, or a notification in the MES dashboard).

- Process Automation & Autonomous Control: EGA is exploring partial autonomy in operations. The ultimate vision (perhaps in EX tech) is autonomous control of pots, cranes, and vehicles using AI[14]. Already, EGA’s AI might adjust certain process setpoints automatically. For example, if AI detects that a pot’s temperature is trending high due to anode age, it could automatically tweak the alumina feed algorithm or electrolyte chemistry to compensate – acting as a Level 2.5 optimizer above the PCS. EGA’s digital platform has been described as harnessing AI “at scale” to transform operations[8]. Another area is production scheduling optimization: using AI to dynamically schedule or sequence jobs to maximize throughput and minimize downtimes. While SAP and MES handle core scheduling, an AI could simulate many scenarios rapidly to suggest an optimal plan (like which cast house to route metal to, or how to blend bauxite from different sources to meet quality at lowest cost). EGA’s mention of using a “simulation-based digital model” to optimize inbound logistics (cutting shipping delays 50%)[6] and using GenAI in procurement (saving 30% of buyer time)[6][6] shows how AI is pervasive from operations to admin processes. EGA even envisions providing its digital solutions to others in the industry ecosystem[6], indicating confidence that their AI-enhanced processes are world-class.

- AI for Market and Business Analytics: Outside the plant, EGA uses AI to forecast markets (they have tools predicting commodity price movements[10]) and likely for customer demand forecasting. While not directly an ISA-95 Level, these AI insights feed into Level 4 planning – for example, better demand forecasts allow ERP to plan production more effectively, and in turn the MES can be proactive.

Challenges and How EGA Addresses Them: Even for a tech-leading company like EGA, integrating systems and AI at this scale comes with challenges:

- Real-Time Data Synchronization: Ensuring that the torrent of real-time data from operations (pots, sensors, etc.) is reliably and quickly communicated upward is non-trivial. EGA had to implement a robust industrial connectivity solution (e.g. IoT gateways, possibly Azure IoT Edge, etc.) to get 2.9 PB/year from the plants to the cloud[8]. They use hybrid cloud to mitigate latency, but still network reliability is critical. Any hiccup in synchronization could lead to decisions on stale data. EGA likely addressed this with buffered messaging (ensuring no data loss on disconnect) and perhaps local fall-back modes. The 13× speed increase in AI response[8] suggests they overcame prior bottlenecks by optimizing data pipelines.

- Cybersecurity: Connecting smelter control systems to cloud platforms raises security concerns. An attack or breach could be catastrophic (imagine potline control being hacked). EGA must maintain strict security: network segmentation, encryption of data from plant to cloud, and continuous monitoring. The mention of using “architecture used in defense projects”[8] implies hardened security and reliability. EGA probably implemented a layered Defense-in-Depth strategy, working closely with Microsoft’s experts. As a result, they can reap cloud benefits without exposing critical control to the wild internet.

- Workforce Change Management: EGA’s transformation is as much about people as tech. Rolling out dozens of new digital apps and AI tools means employees had to change how they work – operators now might consult mobile apps, data scientists may work alongside engineers, and decisions might come from algorithmic insights rather than solely human experience. EGA tackled this by training ~3,000 employees via a Digital Academy and instilling agile, collaborative culture[6]. They also have an internal suggestion scheme and improvement teams (Tamayaz) that engage employees in innovation[5] – harnessing grassroots ideas. The result is evident: over 330,000 employee improvement ideas were implemented by 2024[5], savings tens of millions. By involving employees at all levels and providing training, EGA mitigated resistance and built digital literacy, ensuring their sophisticated ISA-95 integrated systems are actually utilized effectively, not underused or bypassed.

- Scalability and Data Management: Handling big data and AI models enterprise-wide can become unwieldy. EGA preemptively built governance and data infrastructure (cut storage needs 80%, increased processing 35× with new architecture)[6]. They likely use cloud auto-scaling and big data tools to ensure as operations grow or new sensors are added, the systems can scale. Standardizing on one platform (Azure) and one ERP (SAP) also reduces complexity compared to managing heterogeneous systems.

In summary, EGA’s case demonstrates a top-down digital integration: Proprietary Level 1/2 controls for process expertise, a cutting-edge Level 3 platform for Industry 4.0 capabilities, and a modern Level 4 ERP to tie it into business – all unified under strong governance and an ambitious AI-driven strategy. This has positioned EGA as a global lighthouse for smart manufacturing, with tangible benefits like higher throughput, lower costs, improved safety, and a future-proof architecture for continuing innovation[6][6].

Case Study 2 – Hadeed Manufacturing (Syria)

Introduction to Hadeed (Syria): Hadeed (an Arabic word for iron/steel) is a pseudonym for a heavy industrial steel manufacturing plant in Syria. This mid-sized plant operates in a cost-constrained, challenging environment – Syria has faced sanctions and economic hardships, limiting access to high-end technology. Despite this, Hadeed has pursued an automation and digital strategy tailored to its context, combining robust industrial equipment from Danieli (an Italian metals industry supplier) with cost-effective open-source software for enterprise management. Hadeed’s production involves typical steel plant stages: possibly scrap metal or direct reduced iron as input, melting in an electric arc furnace or induction furnaces, casting into billets, and rolling those into final steel products (rebars, sections, etc.). It’s a batch-process with high-temperature equipment, where downtime and inefficiency directly impact cost of production.

Levels 0–3: Danieli Automation Systems – Hadeed’s shop-floor automation is delivered by Danieli Automation, a renowned provider of control systems for steel plants. Danieli’s systems cover sensors, PLCs, SCADA, and MES functions in an integrated package, ensuring that Hadeed’s furnaces, casters, and rolling mills run optimally:

- Level 0: All the field devices in Hadeed’s plant – temperature probes in furnaces, flow meters for cooling water, pressure sensors in hydraulics, motors and drives on rolling mill stands, etc. – are sourced or configured through Danieli’s engineering. These devices feed raw data (e.g. furnace temperature readings, motor currents) to the control systems. Danieli being an expert in metals, likely provided Hadeed with a complete instrumentation package designed for the harsh meltshop environment[3][3]. For example, special load cells might measure the billet weights, and infrared scanners measure the rolled steel temperature.

- Level 1: Hadeed’s basic control is handled by Danieli PLCs and dedicated controllers. Danieli Automation often uses standard PLC hardware (perhaps Siemens or Rockwell) but with their application libraries for metals. These PLCs control individual equipment: one PLC might control the electric arc furnace, executing the recipe (charge materials, control electrode movements, etc.), another PLC controls the continuous caster (withdrawal speed, cooling), and so on. HMIs installed near machines allow local operators to intervene (for instance, a furnace panel to adjust setpoints). The logic in these PLCs executes real-time, maintaining stable operation of each unit – e.g. keeping rolling mill motors synchronized to avoid tension in the steel bar. Danieli’s Level 1 focus is on reliable, precise control of machinery, leveraging its metallurgical know-how (like specific control loops for steel chemistry or rolling thickness control)[3][3].

- Level 2: At Hadeed, Danieli’s Level 2 supervisory systems oversee the whole production line. Danieli provides SCADA and process control solutions often tailored for steel. For example, Danieli’s automation suite includes Level 2 process control models for steelmaking – like dynamic heat control for furnaces, automatic pacing of the caster and mill to match throughput, and quality control systems that analyze sensor data to ensure product specs[3][3]. The SCADA aggregates data from all PLCs, showing operators a unified view (mimics of the furnace, caster, rolling mill, etc. on screen). It handles supervisory tasks such as coordinating between subsystems: when a new heat (batch) is ready to be tapped from the furnace, Level 2 will alert the caster to get ready, and ensure the rolling mill is prepared for the incoming billet. It also collects process data for each heat and load – temperatures, durations, delays – and might automatically generate reports on production and quality[3][3]. In short, Danieli’s Level 2 acts as the “brain” of Hadeed’s plant, making higher-level decisions to optimize throughput and quality (e.g. adjusting furnace power to maintain target temperature or changing mill settings for desired product dimensions).

- Level 3: Danieli offers MES-like systems (sometimes branded as Danieli MET for Manufacturing Execution). In Hadeed’s case, Danieli’s Level 3 likely covers production management functions: tracking each order through the plant, recording what was produced, managing recipes and schedules for each day’s production[3][3]. For example, if Hadeed has an order to produce 1000 tons of rebar of a certain size, the Level 3 system would schedule how many heats to melt, how to cast and roll them, and monitor progress. It interfaces closely with Level 2: dispatching work orders to start a new batch, then monitoring sensors to mark that batch as completed and capturing its data. Danieli’s MES can handle material tracking (linking raw material batches to finished steel batches for traceability), downtime tracking, and performance KPIs[3][3]. It may also integrate with lab systems for chemical analysis results, ensuring quality certs can be generated for each batch of steel.

- It’s worth noting that for smaller plants like Hadeed, Danieli’s Level 2/3 might be combined or lean. Often, the Level 3 functions (order scheduling, etc.) could be done partly in the ERP if the MES is not fully featured. However, given Danieli’s involvement, Hadeed likely got at least a basic MES module from Danieli for the meltshop and rolling mill. This ensures that production operations can continue even if external systems (like internet or ERP) are offline – a key consideration in Syria, where connectivity can be unreliable.

Level 4: ERPNext by Clefincode for Enterprise Management – Instead of an expensive commercial ERP, Hadeed uses ERPNext, an open-source ERP platform, implemented and customized by ClefinCode (a Syrian IT firm). ERPNext provides a full suite of enterprise management modules out-of-the-box, which Clefincode tailored to Hadeed’s needs. At Hadeed, ERPNext covers: Sales and Purchasing, Inventory, Accounting, HR, and crucially Production Planning and Stock/Material management. Here’s how ERPNext fits Hadeed:

- Sales & CRM: Hadeed’s sales team enters customer orders (e.g. X tons of rebar of grade Y for delivery by Z date) into ERPNext. ERPNext handles quotations, sales orders, and eventually invoices once products are delivered. The Customer Portal feature of ERPNext, possibly enhanced by ClefinCode Chat, allows customers to interact – for instance, a client might log in to see their order status or to communicate about specs. Clefincode’s solution likely provides a portal where customers can place or track orders and even chat with Hadeed’s sales reps through an integrated chat (ClefinCode Chat) channel rather than back-and-forth emails. This modern customer interface is notable in a Syrian context, giving Hadeed a professional digital face.

- Materials & Inventory: ERPNext keeps records of raw materials (scrap metal, alloys, billets if any are bought, etc.), as well as finished goods inventory. Each batch of steel produced is recorded in ERPNext’s stock module, tagged by batch/heat number. ERPNext supports batch tracking, so Hadeed can trace which raw material lots went into which steel batch – critical for quality assurance and perhaps for any certification needs. When production is reported from the plant, the ERPNext system is updated to move items from Work-in-Progress to Finished Goods stock. Inventory management in ERPNext also helps Purchasing: for example, if scrap stock falls below a threshold, ERPNext can trigger a Material Request for procurement.

- Production Planning: Hadeed’s planning department uses ERPNext’s production module to plan manufacturing based on sales orders. They can create Production Orders in ERPNext for each batch or campaign to produce. However, rather than ERPNext directly driving shop floor processes, these production orders must be communicated to Danieli’s Level 3 MES. Clefincode likely implemented custom integration so that when a Production Order is created or set as “Ready to Schedule” in ERPNext (Level 4), it sends a signal or data to Danieli’s system (Level 3). Perhaps a custom script in ERPNext calls an API or writes to a database/table that Danieli’s MES can read. This integration ensures no manual re-entry – when sales confirms an order in ERPNext, the plant gets the instructions electronically.

- Purchasing & Supply Chain: ERPNext manages Hadeed’s procurement of spare parts, consumables, and raw materials. Purchase Orders, supplier info, and even RFQs can be handled in the system. One advantage is localization – Clefincode would have configured ERPNext with Syrian accounting standards, multiple currencies, and possibly Arabic language support, making it user-friendly for Hadeed’s staff. When the production plan indicates more scrap is needed, ERPNext can generate Purchase Requests. Also, integration might extend here: if Danieli’s automation tracks raw material consumption in real time (e.g. X tons of scrap used today), that data can feed back to ERPNext to decrement inventory immediately[3][3], giving procurement a live view of stock levels.

- Quality, Maintenance, HR: ERPNext likely also supports Hadeed in these areas. For quality, test certificates for each batch (chemical composition, mechanical properties) can be stored and even printed from ERPNext, as lab results can be entered and tied to production lots. Maintenance management might be done in ERPNext by logging equipment, maintenance schedules, and downtime reports – though Danieli’s system would capture runtime hours and breakdown events, Clefincode could integrate that data so ERPNext’s maintenance module has accurate info (like which equipment is due for maintenance based on hours of operation). HR in ERPNext handles payroll, attendance, etc., and possibly ties into shop floor data (e.g. linking overtime hours to production output).

Overall, ERPNext provides Hadeed a unified platform at Level 4 that is affordable (no license costs) and flexible. Clefincode, as the implementer, customized forms and workflows to match Hadeed’s processes exactly, which is a big plus of open-source. For example, they might have a custom doctype for “Heat” or “Batch” that links production orders, quality results, and stock entries in one view.

Integration between Danieli Automation (Levels 0–3) and ERPNext (Level 4): The crux of Hadeed’s digital setup is the data exchange between the factory floor and the ERP:

- Production Orders and Schedules: When ERPNext creates a production plan (based on orders), this needs to be conveyed to the Danieli MES. In practice, Clefincode could have built an “integration agent” – a small on-premise service that queries ERPNext for new or scheduled Production Orders and then injects them into Danieli’s system. Given internet in Syria can be spotty, Hadeed likely runs ERPNext on a cloud (Clefincode Cloud on AWS) for reliability, but they have an on-premises agent at the factory that caches and forwards data. This agent might use API calls to ERPNext (which is cloud-hosted) to fetch work orders and then use OPC UA or a direct database connection to Danieli’s Level 3 to create the corresponding schedule entry. This way, even if the internet blips, the agent at the plant has the info needed to keep the production going, and will sync back when connection restores – an architecture Clefincode uses for linking on-site manufacturing to online ERP.

- Shop Floor Feedback: As production progresses, Danieli’s Level 2/3 systems gather data on each batch (actual start time, end time, quantity produced, temperatures, any delays). This execution data must flow back to ERPNext to close the loop[3][3]. The integration agent likely listens to the MES or gets signals when a batch is completed. It then calls ERPNext’s API to update the Production Order as completed, record the produced quantity in stock, and log any scrap or downtime. For example, if Heat #101 produced 95 tons of steel and 0.5 ton scrap, the agent would post that to ERPNext, which would: mark Production Order #101 done with 95 tons output, increase Finished Goods inventory by 95 tons, and perhaps create a Scrap record. This near-real-time update gives management visibility: they can open ERPNext and see current production status (like 3 of 10 batches completed today, with yields, etc.). In case of issues (say a batch aborted due to equipment fault), the agent can update ERPNext so that the planners know to reschedule or inform customers.

- Material Consumption and Inventory Sync: Integration ensures that as the shop consumes raw materials (scrap, alloys) and produces products, ERPNext’s inventory reflects it without manual stock entries. Danieli’s system will know how much of each raw material was charged into the furnace for a heat. The agent can take that info and create a “Stock Entry” in ERPNext to deduct that quantity from the raw material warehouse in ERPNext[3][3]. Conversely, when products are made, ERPNext inventory goes up. This eliminates double-entry and delays – accounting can get an automatic view of current stock, which is essential for a just-in-time operation or simply to avoid running out of critical inputs.

- Quality and Traceability Data: Danieli Level 2 likely records process parameters for each batch (temperature curves, etc.) and lab results. While not all that detail needs to live in ERPNext, key quality outcomes do. For instance, if a batch’s lab test results come in, Clefincode might have built a small interface for the quality engineer to enter them in ERPNext (or it could be automated if Danieli’s system exports a file). ERPNext can then generate a quality certificate or attach results to the batch record, which can be printed for customers. Additionally, if any batch fails to meet spec, ERPNext can trigger workflows (like quarantine stock, notify sales). This integration ensures that quality issues on the shop floor are known to the business side immediately – important for customer communication.

- Feedback Loops for Planning: The data exchange also allows better planning. If, for example, Danieli MES reports that production is ahead or behind schedule, ERPNext can adjust delivery dates or procurement needs. In a simple form, this might be an automated status update – e.g., if an order’s last batch is completed in MES, ERPNext could automatically mark the Sales Order as ready to deliver. Another feedback is downtime: if a critical machine at Hadeed breaks and MES logs a downtime event, that info can be sent to ERPNext to adjust production plans and possibly alert procurement if external processing is needed. In essence, ERPNext becomes the system of record for all production events after-the-fact, while Danieli controls them in real-time – aligning with best practice that “Level 2 stays in control, Level 4 plans and records”[3][3].

Clefincode’s integration likely uses a combination of APIs and database connectors. If Danieli’s MES has an open database or export function, the on-premise agent could read that and then call ERPNext’s REST API. Alternatively, a more live method: use OPC UA servers in Danieli to publish production events, and the agent subscribes and pushes to ERPNext. There might not be a pre-built connector (unlike big vendors, here a custom solution was needed)[3], but the benefit is a highly tailored integration at low cost.

Open-Source ERPNext vs Proprietary Systems: The choice of ERPNext (open-source) to complement Danieli’s proprietary OT systems is deliberate and illustrates how a cost-efficient, flexible stack can be built:

- Cost Efficiency: ERPNext has no licensing fees – Hadeed avoids the heavy costs of SAP or similar (which also might be impossible due to sanctions or budget). Danieli’s automation came likely as part of the plant’s equipment package (capital expenditure when the plant was built). Thus, the ongoing software costs are minimal: Hadeed pays only for Clefincode’s implementation services and any cloud hosting. This leads to a far lower TCO (Total Cost of Ownership) compared to if they tried to deploy a full SAP MES + SAP ERP stack[3][3]. In Syria’s economic climate, this can be the difference between having an integrated system or having nothing at all. By saving on software costs, Hadeed can invest in other areas (or simply preserve margins).

- Customization and Localization: Open-source allowed Clefincode to customize ERPNext deeply for Hadeed’s local needs – something harder with off-the-shelf ERPs. They could add custom fields (in Arabic) and logic to fit Hadeed’s processes, rather than Hadeed changing its processes to fit the software. This flexibility is extremely valuable for a mid-sized manufacturer that may have unique ways of operating. Moreover, Clefincode could implement Syrian tax law, multi-currency handling for imports, and even workflows in ERPNext that match Hadeed’s approvals process. The result is a solution that users find intuitive and which doesn’t include unnecessary complexity. For example, if Hadeed doesn’t need a complex production scheduling algorithm, Clefincode might have simplified that in ERPNext’s interface, leaving sophisticated scheduling to Danieli’s MES.

- Vendor Independence and Local Support: With ERPNext, Hadeed isn’t locked to a foreign vendor’s timeline or support contracts. They have the source code and a local partner (Clefincode) with expertise. This is particularly important given international sanctions – relying on a cloud service from abroad might be risky if access could be revoked. Instead, Clefincode can even deploy ERPNext on-premises if needed, or on servers in a friendly region. The support is local, in the same time zone and language. If Hadeed wants a new feature (say a new report or a change in workflow), Clefincode can implement it quickly without waiting on a global vendor’s release cycle. This agility means the system evolves with Hadeed’s business. As Clefincode highlights, an ERPNext + Danieli approach is “leaner and more customizable, with the freedom of open-source” compared to heavy proprietary suites[3][3].

- Challenges of Integration: The flip side is the integration effort – since ERPNext and Danieli are from different worlds, Clefincode had to build the connectors (there’s no pre-built “Danieli-ERPNext” module)[3]. This requires skilled implementers and knowledge of both systems. However, Clefincode appears to have that know-how, and once built, the integration runs under Hadeed’s control. Another challenge is convincing stakeholders: some engineers might initially distrust an open-source ERP as being less “proven” than SAP, or worry that custom integrations are fragile. But the success of Hadeed’s system proves that with proper engineering, open-source can indeed run a steel plant’s business side effectively.

- Feature Completeness: Modern proprietary MES/ERP systems often come with specialized features (e.g. a steel-specific module, advanced planning optimizers, etc.). ERPNext is general-purpose, so Clefincode had to ensure all needed features were configured. They leveraged ERPNext’s manufacturing module (which supports multi-level BOMs, work orders, etc.) and extended where necessary. For instance, steel industry may require tracking heats and chemical analyses – if ERPNext didn’t have a field for, say, “Carbon content %” on a batch, Clefincode could add it. Danieli’s systems cover the niche process control well, so ERPNext didn’t have to – it just needed to capture the high-level results. In effect, Hadeed uses a hybrid MES approach: Danieli for real-time and short-term execution, ERPNext for higher-level coordination and record-keeping[3][3]. This plays to each side’s strengths.

In summary, Hadeed’s integration approach is to keep the heavy-lifting of real-time control within Danieli’s proprietary automation (Levels 0–3) and use ERPNext at Level 4 as the brain for planning, analysis, and overall enterprise coordination, with a custom-built data bridge between them[3][3]. It’s a practical and economical strategy: use the best of industrial vendors for what they do best (running machines), and use open-source IT solutions to avoid exorbitant costs for the business side. The result is a digitally enabled steel plant on par with much larger operations, but achieved at a fraction of the software cost.

AI and Smart Automation at Hadeed: While Hadeed’s current setup focuses on core automation and ERP, they are exploring AI-driven enhancements in line with global trends (though on a smaller scale compared to EGA):

One flagship project is the “Hadeed Smart Gate.” This project showcases how AI and IoT can improve security and logistics even in a local context:

- AI-Enabled Gate Control: Hadeed’s facility likely has a gated entrance for trucks delivering scrap or picking up finished steel. The Smart Gate uses cameras and sensors to automate this flow. AI cameras at the gate automatically read truck license plates and perhaps recognize the truck’s ID or driver via computer vision. Simultaneously, a weight bridge measures the truck’s weight to verify its load. These inputs are cross-checked against ERPNext’s database: for example, if a truck is scheduled to pick up 20 tons of rebar (a delivery recorded in ERPNext with that truck’s ID), the system knows the expected plate number and weight. If the AI camera and scale data match an authorized sales order or delivery note in ERPNext (pre-approved order), the gate system can automatically allow entry or exit[4][4]. It might physically open the gate via a barrier control system and send a notification that “Truck XYZ carrying Order #123 has entered.” This eliminates manual guard paperwork and speeds up throughput.

- Automatic Approval/Rejection & Alerts: If a truck arrives that is not in the day’s schedule, the AI system flags it as unauthorized. For instance, a truck’s plate not matching any expected deliveries triggers an alert. The Smart Gate could then deny access (keeping the barrier closed) and simultaneously notify Hadeed’s security or management. Notifications could be sent via SMS or, within the company, via an integrated chat app (Clefincode Chat) that pops an alert in the relevant group channel (e.g. Logistics or Security group) – “Alert: Unscheduled truck ABC attempting entry” – so managers can quickly respond. This integration with a chat/notification system ensures real-time awareness; managers don’t have to be at the gate – they’ll get an alert on their phone or PC.

- Load Verification: For outgoing shipments, the system can compare the measured truck weight (after loading) with the invoice weight from ERPNext. If a significant discrepancy is found, it halts the process for investigation (maybe some product was not loaded or weight measurement issues). Similarly, for incoming scrap deliveries, it can verify if the weight delivered matches the purchase order quantity. This tight integration of AI sensing with ERP data improves accuracy and trust – both Hadeed and its customers can be assured that quantities are right.

- Safety and Security AI: The Smart Gate’s cameras also enhance security beyond checking orders. They can use object detection to ensure only one vehicle passes per open gate (prevent tailgating) and even detect if people are in unsafe zones near the gate. Also, because Syria’s context might have security risks, an AI camera could identify suspicious behaviors or unauthorized personnel. If someone tries to sneak in on a truck, the system could detect a human figure where none should be[4][4] and immediately raise an alarm.

All this is done with minimal human intervention, which is particularly useful if Hadeed operates with lean staffing. The Smart Gate likely uses edge computing – the AI computations (license plate recognition, etc.) run on a local device (maybe an industrial PC with a GPU or a smart camera unit) at the gate, so it works even if the internet or central systems are down. It then syncs or logs data to ERPNext (e.g. recording the time of entry for the truck in the delivery record) when connectivity is available[4][4]. This design shows how edge AI can be deployed on-site for instant action, while still integrating with the cloud ERP for record-keeping.

AI for Safety Monitoring: Inside the Hadeed plant, even if not as advanced as EGA’s, they are interested in AI for safety and quality. Possibilities include:

- PPE Compliance Cameras: Mounting cameras in key areas (like furnace platform, or rolling mill entry) that use AI to check if workers are wearing helmets, gloves, and goggles. If someone is detected without required PPE, the system could send an automatic message (perhaps to a supervisor or to the worker’s phone if identified)[4]. This creates a continuous safety enforcement mechanism. Clefincode Chat might serve here by channeling alerts: e.g. a bot in the chat posts “Warning: Operator in Meltshop not wearing helmet (camera 3)[12].” This not only alerts in real time but also logs an incident for later review or training.

- Equipment Anomaly Detection: Using sensors (vibration, temperature) on critical machines (like mill stands, gearboxes) plus AI anomaly detection models could predict failures. If a rolling mill bearing starts to vibrate abnormally, an AI model could catch that pattern and notify maintenance. While Danieli’s system has basic alarms, an AI could detect subtler signs or combine multiple signals (sound, vibration, heat) for early warning. This could feed into ERPNext by automatically creating a Maintenance Request or To-Do for the maintenance team with the data attached.

- Quality Control Vision: Even with a lower budget, deploying a simple computer vision on the line – e.g. a camera at the rolling mill exit checking surface quality of bars or correct bundle tagging – can be done with open-source tools (OpenCV, etc.) and integrated with ERPNext. If a defect is noticed (say the camera spots a mis-shaped bar or improper bundling), it could flag that batch in ERPNext’s quality module as “Need Review” and alert quality engineers.

- Autonomous Material Handling: In the future, Hadeed might consider semi-autonomous cranes or forklifts for moving scrap or products. AI route-finding and sensors on these vehicles could reduce accidents and improve efficiency in the yard. For now, that might be aspirational, but as global trends make such tech cheaper, it’s a direction even mid-sized plants will go.

Open-Source IoT & AI Solutions: Clefincode can leverage open-source and affordable tech for these AI use cases. For example, using Node-RED or custom Python as middleware, connecting an Edge AI camera (like a Raspberry Pi with camera running YOLO object detection) to ERPNext via API is quite feasible and cost-effective[4][4]. MQTT brokers can handle streaming of sensor data to ERPNext with low bandwidth, ideal for connecting a site like Hadeed’s to the cloud ERP[4][4]. The Clefincode Cloud service presumably provides a secure AWS-hosted environment for ERPNext, and maybe additional services like an MQTT broker or data store for IoT data that the on-premise agents publish to. By running small agents on-premises at Hadeed (for integration and perhaps initial data processing), Clefincode ensures all Level 0–3 systems talk to the cloud ERP reliably. This agent architecture is a smart workaround to Syria’s connectivity issues: if internet drops, the agent queues data, and production continues unaffected; when back up, it syncs. It also provides a layer of security (the agent can enforce what data goes out or what commands come in, protecting the plant floor).

Workforce and Process Adaptation: Implementing these systems at Hadeed requires significant training and workflow design. Many workers might be used to manual record-keeping or stand-alone systems. Clefincode likely spent time training Hadeed’s staff at all levels – from plant operators to accountants – on the new integrated system. For instance:

- Operators needed to learn how to use the new SCADA/MES interfaces (in Arabic possibly) and how to report or acknowledge production in the system (instead of paper logs).

- Production planners had to learn ERPNext’s production module, creating work orders and interpreting the dashboards that show progress.

- Management learned to use real-time reports from ERPNext instead of waiting for end-of-day reports. Clefincode Chat may have been introduced as a communication tool, so managers and floor supervisors can communicate in real time and share data (like a supervisor could send a photo of a product via the chat linked to a Work Order document for clarification of an issue[12][12]).

Role-based workflows were configured in ERPNext: e.g., a sales order triggers a workflow where production planning must approve it (checking capacity), then it flows to procurement to ensure raw materials, then to production scheduling. Each department has specific tasks and system permissions. By designing these role-based flows, Hadeed ensures accountability and that the digital process aligns with their organizational structure – no step gets skipped because the system enforces the sequence (for example, you can’t start production in ERPNext until QA approves the raw material certificate, if that’s a rule configured).

Training all employees was crucial so they understand not just which buttons to click, but the importance of the data they input. When everyone from furnace operator to sales clerk sees the benefits – less duplicate work, no lost paperwork, faster decisions – they are more likely to embrace the new system. Given the successful operation, it appears Hadeed’s workforce did adapt, aided by Clefincode’s support. Over time, as they become comfortable, Hadeed can further refine workflows (maybe adding more automation or AI assistance in decision-making).

Finally, Hadeed’s case underscores that even a sanctioned, resource-limited environment can achieve a near state-of-the-art ISA-95 integration by cleverly using a mix of proven industrial tech and innovative open-source IT, anchored by strong local expertise and training. This positions Hadeed to gradually adopt more advanced Industry 4.0 features (like the AI examples) as their comfort and needs grow, without a huge leap in investment.

AI and Smart Automation Applications in Modern Manufacturing

Across the industry, manufacturers are leveraging Artificial Intelligence (AI) from the shop floor (Level 0–2 sensors and control) up to enterprise planning (Level 4 ERP analytics). Below are key AI-driven applications mapped to ISA-95 levels and functions, with examples relevant to both a large player like EGA and a smaller one like Hadeed:

1. Predictive Maintenance (Level 2–4): AI algorithms analyze data from machines (vibration, temperature, acoustic signals, electrical currents) to predict failures before they happen. Instead of relying on fixed maintenance schedules, AI can warn that, say, a compressor motor is likely to fail in 100 hours due to an anomaly in its vibration signature. These predictions can be fed into the maintenance module of an MES or ERP, automatically creating a work order or alerting maintenance staff to schedule downtime[12][12]. For example, EGA uses ML on potline sensor data to predict and prevent pot failures and optimize anode life. Hadeed could similarly use AI on rolling mill gear vibrations to plan bearing replacements before a catastrophic failure. This reduces unplanned downtime and maintenance costs. The integration aspect is that Level 2 data (sensor readings) flow to an AI service (could be on Level 3 or cloud) which then interacts with Level 4 (ERPNext or SAP) to initiate maintenance actions. We see this in practice: “IoT sensors integrated with ERPNext will collect data from machinery, enabling AI to predict maintenance needs before failures occur…Proactive maintenance will minimize unexpected downtime”[12]. This is a shift from reactive to proactive maintenance across industry.

2. Energy Optimization (Level 2–3): AI helps minimize energy consumption and improve efficiency. In energy-intensive processes (like EGA’s smelting or steel reheating furnaces at Hadeed), AI models can learn the relationship between process parameters and energy use. For instance, an AI might find the optimal temperature profile that uses the least gas in a furnace without affecting steel quality. It might suggest adjusting a setpoint or timing to shave peak power usage. At EGA, AI has been used to cut down the energy per aluminium ton and manage the load on their power plants. An example from industry: AI can modulate aluminum potline current in response to electricity price fluctuations (if on a variable tariff) to reduce cost without harming production[13]. For Hadeed, where electricity supply might be limited, AI could schedule high-power tasks (like melting) during off-peak times or when the factory’s generator is optimally loaded. These decisions often reside in Level 3 (MES or a dedicated energy management system) but require coordination with Level 4 planning (to not miss delivery deadlines). Thus, the MES might use AI to propose a production schedule that balances energy cost and output – a complex optimization that classical methods handle roughly, but AI could fine-tune.

3. Computer Vision for Quality Inspection (Level 2–3): AI-driven vision systems are transforming quality control. High-speed cameras on production lines, combined with real-time image recognition, can inspect products far faster and more consistently than humans. They detect surface defects, dimensional errors, or assembly mistakes. For example, EGA uses computer vision to inspect carbon anodes and finished aluminium for defects (like cracks or inclusions) in real time[10]. Hadeed could employ a vision system to inspect rolled steel surfaces for deformities or detect if rebar ribs (the deformations on rebar for concrete grip) meet the standard. One could set up a camera and lighting at the rolling mill output, and an AI model (like a trained neural network) checks each meter of bar for surface defects or mis-shaped sections. If it finds a defect beyond tolerance, it can mark that section or trigger an alarm. These systems usually operate at Level 2 (directly on the line), sometimes on edge devices, and they send summary results or defect counts to Level 3 for quality records[4][4]. The benefit is catching defects early – possibly even triggering automatic rejection of a piece – thereby preventing a lot of waste or customer complaints. Integration into ERP/MES means that quality data is logged against the batch number. Over time, this data can feed back into AI analysis for process improvement (e.g., “we have 5% more surface defects at night shifts” could prompt investigation or training).

4. Vision-Based Safety and Operational Monitoring (Level 2): Beyond quality, AI vision for safety is gaining traction. Cameras with AI can enforce safety rules automatically. A prime example is PPE detection: an AI model can look at video feed and recognize whether each person is wearing a hard hat, safety glasses, or hi-vis vest[4]. If not, it generates an alert or even uses speakers to give an automated warning. Similarly, zone intrusion detection: defining virtual safe zones around dangerous machines and having AI watch if anyone crosses into that zone during operation[4][4]. If detected, it could trigger an emergency stop via the control system and alert supervisors – potentially life-saving. EGA integrated such video-based safety alerts and saw huge improvements in response time (92% faster)[6]. Hadeed’s Smart Gate and potential in-plant cameras are along these lines. Another use is detecting abnormal behaviors, like a worker who has collapsed (man-down detection) or unauthorized use of a phone in hazardous areas. These AI applications often run on edge devices (Level 2), but log incidents into Level 3/4 systems. For instance, an unsafe behavior incident could automatically create an HSE (Health, Safety, Environment) incident report in the system, assigned for investigation. This ensures safety events are documented and analyzed.

5. AI-Based Production Scheduling and MES Optimization (Level 3): Scheduling in a complex manufacturing environment can be an NP-hard problem (very complex for classical algorithms). AI, especially using techniques like reinforcement learning or advanced solvers, can crunch vast possibilities to find near-optimal schedules. An AI scheduler can consider dozens of variables – machine availability, energy cost, worker shifts, maintenance schedules, due dates – and sequence production orders accordingly, often achieving better asset utilization or lower changeover times than manual scheduling. ERP and MES typically do backward/forward scheduling on defined rules[12], but AI can simulate outcomes (like a chess game) to try various sequences. EGA hinted at such capabilities to minimize changeovers and maximize utilization[12]. In Hadeed’s context, an AI scheduling tool could help plan melts and rolling such that each heat’s grade flows logically (reducing time to change alloy or caster setup) and align production with when inspectors or resources are available. While Hadeed might not have this yet, open-source libraries and increasing computing power make it feasible even for smaller firms in the near future. These AI schedulers would sit at Level 3, integrated with MES/ERP: they take orders from ERP (Level 4) as input and output a schedule that the MES executes. If MES detects a deviation (machine breakdown, etc.), the AI can quickly re-compute a new optimal schedule – providing a degree of agility in operations that manual Gantt charts can’t.

6. Digital Twins and Simulation (Level 3–4): A digital twin is a virtual model of a physical process or system that runs in parallel and is fed with real data. Using AI and simulation, companies can test scenarios on the twin to optimize the real thing. EGA built a simulation-based digital model of its logistics chain which helped cut delays by 50%[6]. In manufacturing, one could have a digital twin of a production line. Operators and planners can simulate “What if we increase the speed by 5%?” or “What if machine X goes down?” and see the impact on throughput and inventories. AI can assist by calibrating the twin with historical data and even running predictive scenarios. Such tools help in planning expansions, scheduling maintenance at the optimal time, or identifying bottlenecks. They usually interface with MES (getting real production data to stay accurate) and ERP (to incorporate costs or constraints like supply deliveries). For Hadeed, a digital twin could simulate how to recover if the furnace trips – how many extra hours needed, will orders be late, etc., thus aiding contingency planning. As IoT and AI tech mature, digital twins are becoming accessible beyond just mega-corporations.

7. AI in Supply Chain and Logistics (Level 4): At the ERP level, AI helps forecast demand, optimize inventory levels, and even automate procurement. EGA uses AI to predict commodity market movements and likely to forecast customer demand, feeding those into planning[10]. AI can identify patterns (e.g., certain seasonal effects or macroeconomic indicators affecting metal demand) better than humans. For a smaller player like Hadeed, AI could forecast steel price trends or rebar demand in local markets, helping them adjust production or inventory. Also, AI can optimize delivery routes, combine shipments to save costs, or predict supplier lead time issues (using supplier performance data). These applications integrate with ERPNext by augmenting its planning modules: for instance, an AI script might analyze ERP sales data and external data (construction permits issued, etc.) to forecast rebar demand for the next quarter, then automatically adjust the production plan or at least suggest it to planners. Similarly, AI could scan purchase history and market prices to suggest the best time to buy scrap metal or identify a cheaper supplier – essentially an AI assistant for the procurement officer.