Supply Chain Management Resilience: Strategies and Applications with ERPNext

Supply Chain Management (SCM) is the backbone of modern commerce, orchestrating the flow of materials, information, and finances across the entire value chain. This comprehensive report delves into SCM’s core principles, its evolving strategies (from lean efficiency to agile responsiveness), and the multifaceted challenges it faces – from demand volatility and global disruptions to sustainability pressures. It further explores how Enterprise Resource Planning (ERP) systems, with a focus on ERPNext, can be leveraged and customized to strengthen supply chains, enhance visibility, and build resilience against shocks. Key insights and findings include:

- Foundations of SCM: Effective supply chain management integrates sourcing, production, logistics, and distribution to meet customer needs efficiently. Historical evolution has taken SCM from fragmented logistics functions to integrated end-to-end networks, with objectives spanning cost reduction, speed, and service level improvement. Modern SCM balances competing goals of efficiency (lean operations) and flexibility (agile adaptation).

- SCM Models & Strategies: Push vs. Pull systems and Make-to-Stock vs. Make-to-Order strategies determine how inventory is built and customers are served. Lean supply chains emphasize waste elimination and Just-in-Time inventory for stable demand environments (pioneered by Toyota), whereas Agile supply chains prioritize responsiveness and buffer capacity to handle volatile markets (e.g. fast fashion). Many firms adopt hybrid models that combine push efficiency with pull-based responsiveness in different stages.

- Network Design & Optimization: Strategic design of the supply chain network – deciding the number and location of factories, warehouses, and distribution centers – is critical for cost and service. Companies use optimization models to minimize total logistics costs (transportation, inventory, facility costs) while meeting service targets. Techniques like facility location modeling and route optimization (e.g. using linear programming or simulations) enable data-driven decisions on warehouse placement and transportation routing. Leading firms also use digital twins to simulate supply chain operations; for example, an AI-driven digital twin helped a logistics provider increase warehouse capacity by ~10% without new buildings.

- Inventory Management: Balancing inventory is a perennial challenge. Concepts such as Economic Order Quantity (EOQ) provide formulas for optimal order size to minimize total holding and ordering costs. Safety stock is maintained as a buffer against demand spikes or supplier delays. Techniques like Just-in-Time (JIT) aim to minimize inventory by syncing production with demand, though JIT requires highly reliable suppliers. Poorly managed inventory can lead to the Bullwhip Effect, where small retail demand fluctuations amplify upstream, causing excessive inventory or shortages. Causes of bullwhip include forecast errors, batch ordering, price promotions, and lack of information sharing[1][1]. Mitigation strategies involve improved demand forecasting, real-time data sharing, shorter lead times, and collaborative planning[1][1].

- Supplier Relationship Management (SRM): Selecting and managing suppliers is pivotal for both cost and risk management. Organizations use vendor scoring and qualification systems to evaluate suppliers on quality, reliability, cost, and compliance. Transactional supplier relationships (arm’s-length, focused on price) are suitable for commoditized inputs, whereas strategic partnerships are pursued for critical or high-risk materials. Strategies like the Kraljic matrix segment suppliers by supply risk and profit impact (e.g. “strategic” items warrant partnerships, “leverage” items focus on cost). Best practices in SRM include joint development programs, supplier risk assessments, multi-sourcing to avoid single points of failure, and risk-sharing contracts (for example, longer-term agreements with price or capacity guarantees). In negotiations, a risk-based approach is used – for essential materials, buyers may accept higher prices or commit to volumes in exchange for priority and stability.

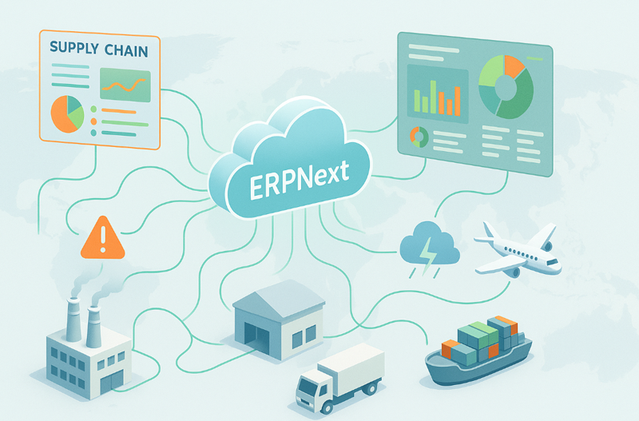

- Technology and Digital Transformation: Technology is a key enabler of modern supply chains. ERP systems like ERPNext serve as the digital backbone, integrating procurement, inventory, production, and order fulfillment data in one platform. This integrated data enhances visibility and coordination across departments. ERPNext, being open-source and modular, covers core SCM functions (inventory management, order management, procurement, basic production planning) and can be extended for advanced needs. For example, ERPNext’s Stock module manages multi-warehouse inventory with real-time stock ledgers and can trigger automatic replenishment requests when levels drop below reorder points. The system supports batch and serial number tracking for traceability, which is crucial for quality control and regulatory compliance in industries like pharmaceuticals. While out-of-the-box ERPNext may lack some specialized supply chain features (e.g. advanced warehouse slotting, sophisticated transport optimization), its open architecture allows businesses to build custom apps or integrate third-party tools. Indeed, companies have extended ERPNext with plugins for carrier shipping label printing, freight tracking, and warehouse barcode scanning. Beyond ERPNext, emerging technologies are transforming SCM: IoT sensors and RFID enable real-time tracking of shipments and inventory (improving visibility from factory to store shelves), Machine Learning (ML) and AI algorithms enhance demand forecasting and dynamic optimization, and blockchain is trialed for secure, transparent tracking of products and transactions. Notably, AI-driven forecasting can reduce inventory by 20–30% while maintaining service levels, and Gartner predicts 75% of companies will adopt “cyber-physical” automation (like mobile robots) in warehouses by 2027[2] to address labor shortages and improve efficiency.

- Sustainability and Green Supply Chains: Environmental sustainability has become an essential objective in SCM. Green supply chain management looks at minimizing ecological impact from sourcing to distribution. This includes measuring a product’s carbon footprint across the supply chain (scope 1, 2, 3 emissions) and redesigning networks to cut emissions – for instance, using more fuel-efficient transport modes, optimizing routes to reduce miles, or near-sourcing to shorten logistics distances. Studies show that value-chain (Scope 3) emissions account for ~90% of many companies’ carbon footprint, so decarbonizing supply chains is key to meeting climate goals[3]. Companies are implementing programs to engage suppliers in reducing emissions (e.g. helping suppliers shift to renewable energy, which could cut millions of tons of CO₂[3]) and using tools to calculate supply chain emissions for disclosure and improvement. Reverse logistics is another pillar of sustainability – reclaiming and recycling products and packaging at end-of-life. Strong reverse logistics (for returns, refurbishments, or recycling) not only reduces waste but also can lower costs and even generate new revenue streams (e.g. resale of refurbished electronics). Circular economy initiatives are emerging, where manufacturers take back used products to recover materials, creating a closed-loop system. Additionally, regulatory compliance frameworks like the EU’s REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) require companies to ensure hazardous materials are limited and tracked in their products[4][5]. Achieving this requires extensive supply chain transparency and data management – often using ERP systems to maintain material composition info and working closely with suppliers to obtain compliance certificates. Leading firms treat sustainability not as a checkbox but as a core supply chain performance metric, tracking carbon per shipment, energy use per unit produced, or % of materials recycled, and incorporating environmental criteria in supplier selection.

- Risk Management and Resilience: The COVID-19 pandemic and other recent crises (natural disasters, geopolitical conflicts) have underscored the vulnerability of global supply chains. Building resilience means identifying risks and preparing strategies to withstand or quickly recover from disruptions. Risk factors include geopolitical (trade wars, sanctions, war and instability), environmental (hurricanes, floods, climate-change-driven events), public health (pandemics), economic (demand shocks, currency fluctuations), and even cyber risks (attacks on supply chain IT systems). Traditional just-in-time models, while efficient, were exposed as brittle during COVID-19 when even brief supplier shutdowns left downstream factories idle. As a result, many companies are rethinking strategies: increasing safety stocks of critical components, qualifying alternate suppliers or sites (multi-sourcing and “China+1” strategies to avoid over-reliance on one country), and geographically diversifying supply bases. Business continuity planning is now front-and-center – companies simulate scenarios (e.g. “what if supplier X in Asia goes offline for 2 months?”) and devise contingency plans such as alternative sourcing, transferable production across facilities, or substitution of materials. Lessons from COVID-19 documented in industry forums include the importance of faster response times and cross-functional communication – firms that fared better had early warning systems and agile decision-making that allowed them to redirect logistics or find new sources quickly. Internal silos hindered crisis response, whereas those who empowered cross-department teams and kept information flowing with suppliers and customers managed to mitigate the damage. A striking example of pandemic shock was the eight-fold increase in container shipping rates and 25% longer transit times seen in 2021, which caught many by surprise. Now companies are incorporating logistics market data into their planning (e.g. monitoring freight rate indexes, port congestion, and even political developments). Resilience also involves supplier resilience: practices like vendor financial monitoring, helping key suppliers in crisis (through loans or joint initiatives), and localizing or dual sourcing essential inputs (even if it raises costs). In the case of the 2022 Russia-Ukraine war, firms had to rapidly find alternatives for commodities like neon gas (critical for semiconductors) and reroute supply chains around sanctions – those with flexible networks and good visibility could adapt faster. The War in Ukraine and other geopolitical events have reinforced the need for “risk-adjusted” supply chain strategies, balancing cost optimization with risk exposure. Many large manufacturers are now mapping their sub-tiers of supply (beyond direct suppliers) to identify hidden single points of failure deep in the chain (e.g. a tiny subcomponent made in only one factory worldwide). Digital risk management tools and control towers are being used to get real-time alerts (for instance, an AI might flag if a hurricane is forecasted near a supplier’s plant, prompting preemptive stock build or alternate sourcing).

- Global Trends and Challenges: Supply chains are increasingly global and complex, which introduces both opportunities and challenges. Globalization over past decades led companies to outsource and offshore production to low-cost regions, optimizing for cost – but at the expense of longer lead times and higher risk. Today, there is a trend towards regionalization or “nearshoring” as firms reconsider this balance, aiming to be closer to end markets for resilience and speed (e.g. U.S. firms bringing some manufacturing back to North America). Trade policies like tariffs and trade agreements also influence network decisions – the US-China trade war, for example, led to supply base shifts for some electronics and apparel companies to Southeast Asia or India to avoid tariffs. Embargoes and sanctions (like those on certain countries) can abruptly cut off supply of raw materials (such as sanctioned metals or oil), requiring agility in sourcing. Natural disasters and seasonal effects remain a constant battle: companies must plan around events like monsoon season disrupting Asian suppliers or winter storms delaying trucking in Northern regions. This might involve building seasonal inventory buffers or using alternative transport modes during high-risk periods. Raw material shortages have had cascading effects in recent years – for instance, the global semiconductor chip shortage (exacerbated by pandemic demand shifts and disasters like a Japanese chip plant fire) crippled automobile production worldwide in 2020-2021, illustrating how a bottleneck in one component can halt an entire industry. Similarly, shortages of lithium and rare earth metals (needed for batteries and electronics) are impacting the tech and automotive sectors, driving up prices and forcing innovation in materials (or recycling). In each case, the lesson is that end-to-end visibility and agility are crucial: companies must monitor not just their immediate suppliers, but the overall supply ecosystem and macro trends (e.g. commodity markets, regulatory changes, labor disputes) to proactively address potential disruptions.

- Performance Measurement and KPIs: To manage such complex supply chains, organizations rely on a suite of key performance indicators (KPIs) and frameworks like the Supply Chain Operations Reference (SCOR) model to measure and improve performance. Common metrics include service metrics (e.g. On-Time Delivery Rate, Order Fill Rate, Perfect Order % – measuring reliability in meeting customer demand), time metrics (e.g. Order-to-Delivery Lead Time, Supply Chain Cycle Time, Cash-to-Cash Cycle which measures how long cash is tied up in inventory from payment for materials to payment from customers), cost metrics (e.g. Cost of Goods Sold, Total Supply Chain Management Cost as % of Sales, Freight spend per unit), and asset/utilization metrics (e.g. Inventory Turnover, Days of Supply on hand, Capacity Utilization). The SCOR model provides a standard vocabulary for these, categorizing metrics under Reliability, Responsiveness, Agility, Costs, and Asset Management Efficiency. For instance, Reliability encompasses on-time performance and order accuracy; Responsiveness measures the speed of fulfillment (order lead times); Agility reflects how quickly the supply chain can adapt to disruptions or demand changes (e.g. upside flexibility – the ability to scale up output in a crisis); Cost covers various cost metrics; Asset Management looks at inventory days and asset turns. Companies often use dashboard software (often integrated within ERP systems) to get real-time visibility into these KPIs. In ERPNext, for example, users can create custom dashboards that display live metrics like current stock levels vs. targets, open orders and their fulfillment status, procurement spend vs. budget, etc. This real-time reporting helps in data-driven decision-making – e.g., if the order fulfillment rate is dipping, managers can drill down into ERPNext to see if it’s due to inventory stockouts or production delays, and take corrective action. SCOR’s framework also encourages continuous benchmarking: comparing one’s metrics to industry standards or past performance to identify gaps. If an Order-to-Cash cycle is longer than industry norm, it might indicate process inefficiencies (perhaps too much waiting time or slow invoicing) that can be improved by process changes or further ERP automation. Performance measurement extends beyond operational metrics to compliance and sustainability KPIs as well – today, executives track metrics like supplier audit scores, % of supply base certified for quality/environment standards, or CO₂ emissions per ton-km of freight. These metrics, when tied to incentives (e.g. part of a supply chain manager’s performance review), help align the organization’s day-to-day operations with its strategic goals.

Overall, the research underscores that effective supply chain management requires both solid fundamentals (strategy, process, and people capabilities) and smart use of technology. ERPNext exemplifies how an ERP can be adapted to an organization’s unique supply chain needs: its open-source flexibility allows adding custom features or integrating with emerging technologies (IoT devices, AI services, communication tools) to create a tailored digital supply chain nerve center. Whether in a single manufacturing SME or a diversified holding company, leveraging such systems can break down information silos, enable end-to-end visibility, and foster collaboration – all essential for agility and resilience. The global disruptions of recent years have been a stress test, revealing weaknesses but also accelerating positive changes: companies are investing in digital transformation, multi-tier supply chain visibility, closer supplier collaboration, and risk-aware planning. In parallel, trends like automation, artificial intelligence, and real-time data connectivity (e.g. via cloud platforms and IoT) are reshaping how supply chains operate, promising faster and more autonomous decision-making (like AI rerouting shipments around a port closure in real time).

In conclusion, organizations that embrace a holistic, technology-enabled approach to SCM – blending efficiency with flexibility, local with global strategies, and cost goals with sustainability and resilience – will be better positioned to thrive in the face of future challenges. The integration of ERPNext with advanced analytics and communication platforms (like ClefinCode Chat) points to a future where supply chain decisions are increasingly data-driven, collaborative, and intelligent, turning lessons learned from past disruptions into a more robust, responsive supply network.

Introduction

Supply Chain Management is often described as the art and science of getting the right product to the right place at the right time, in the right quantity and quality, and at the right cost. This seemingly simple objective conceals a vast web of activities and decisions spanning procurement of raw materials, conversion into finished goods, and distribution to end customers. The concept of SCM has evolved significantly over the past century. In the early 20th century, businesses focused on improving discrete functions like manufacturing efficiency or transportation. The term “logistics” emerged around the mid-20th century, emphasizing distribution and warehousing. By the late 20th century, the perspective widened to integrate all these functions, recognizing that optimizing one node (like production) while neglecting others (like inventory or transportation) could sub-optimize the whole. Thus, Supply Chain Management was born as a holistic discipline concerned with end-to-end coordination.

In practical terms, a supply chain encompasses every organization and activity involved in supplying a product to a customer – from upstream suppliers of materials, through manufacturing facilities, warehouses and distribution centers, transportation carriers, down to retailers or direct customers. Managing this chain requires not only internal coordination within one company (e.g. ensuring the sales team’s demand plans align with procurement’s purchasing schedules), but also external coordination between independent organizations (suppliers, logistics providers, distributors). Information sharing and alignment of incentives across these partners are crucial to avoid inefficiencies like the bullwhip effect, which Procter & Gamble famously identified when diaper order fluctuations amplified up their supply network.

SCM objectives have traditionally included cost reduction (minimizing procurement costs, production costs, logistics costs), asset efficiency (reducing inventory and maximizing asset turns), and customer service improvement (faster delivery, higher fill rates). In recent decades, responsiveness and agility have joined the core objectives as demand has become less predictable and product life cycles shorter. Furthermore, sustainability and risk management have risen to prominence as key goals. The notion of the “triple bottom line” – financial, environmental, and social performance – is now influencing supply chain strategies globally.

This report is structured to explore all these facets of supply chain management. We begin with fundamental models and strategies that companies employ to design their supply chains (Section 1 and 2). We then discuss the tactical and operational aspects, such as network design, inventory control, and supplier management (Sections 3, 4, 5). Section 6 covers the technologies transforming SCM, with a special emphasis on ERP systems and the capabilities of ERPNext, an open-source ERP, to support and enhance supply chain operations. In Section 7, we turn to sustainability, examining how greener practices and circular economy principles are being embedded in supply chains. Section 8 deals with risk and resilience, drawing lessons from disruptions like COVID-19. Section 9 outlines current global trends and challenges, providing a contextual backdrop that supply chain professionals must navigate (from geopolitical shifts to raw material crunches). Section 10 discusses performance measurement and continuous improvement frameworks, notably the SCOR model, and how these can be tied into ERPNext dashboards for real-time monitoring.

Throughout, we incorporate real-world case studies and use cases – for instance, illustrating lean vs. agile via Toyota and H&M, or describing how ERPNext was implemented in specific scenarios to improve logistics and supply chain visibility. We also consider perspectives of different organizational scales: the nuances between a single manufacturing business optimizing its immediate supply chain, versus a large holding company that must coordinate supply strategies across multiple diverse subsidiaries. Finally, we delve into emerging ideas, such as integrating communication platforms (e.g. ClefinCode Chat) with ERP systems to break communication silos, and the concept of an AI-powered ERPNext supply chain hub that could allow companies to dynamically find and collaborate with supply chain partners worldwide.

By examining both foundational theory and advanced applications, this study aims to provide a 360° analysis of supply chain management in the current era. The ultimate goal is to outline how companies can adapt their supply chains to be more resilient, agile, and intelligent – often through customization or extension of tools like ERPNext – in the face of evolving challenges and opportunities.

1. Overview of Supply Chain Management

Definition and Scope: Supply Chain Management is the coordinated management of all activities involved in sourcing, procurement, conversion, and logistics. The classic definition by the Association for Supply Chain Management (APICS) is “the design, planning, execution, control, and monitoring of supply chain activities with the objective of creating net value, building a competitive infrastructure, leveraging worldwide logistics, synchronizing supply with demand, and measuring performance globally.” In simpler terms, SCM oversees the entire journey of a product from raw material extraction to end consumer, including the information flows and financial transactions along that journey. This end-to-end view distinguishes SCM from earlier function-specific management (like just focusing on production or transportation). By managing the supply chain as an integrated system, companies aim to reduce waste, drive out costs, and delight customers with the right product availability.

Historical Evolution: SCM thinking has progressed through several stages. In the 1950s-60s, the focus was on internal productivity – techniques like Economic Order Quantity for inventory (developed in 1913) and Materials Requirement Planning (MRP) for production planning emerged. The 1970s-80s saw growing interest in logistics optimization (e.g. efficient warehousing, computerization of inventory control). It wasn’t until the 1990s that the term “supply chain management” gained popularity, emphasizing cross-functional integration (for example, integrating purchasing with manufacturing and distribution). Pioneers like Toyota demonstrated the power of tightly integrating suppliers into production planning (Just-in-Time), while Dell’s build-to-order model showcased integration of customers into production scheduling. The globalization wave in the late 1990s and 2000s extended supply chains worldwide, leveraging low-cost country sourcing and outsourced manufacturing. This created longer, more complex chains and increased the need for coordination and technology (hence the rise of ERP systems in the 1990s to facilitate such coordination). More recently, the 2010s and 2020s have added layers of digital connectivity (cloud-based SCM software, IoT, blockchain pilots) and a focus on resilience and sustainability, influenced by events like trade disputes and the COVID-19 pandemic. SCM is now seen not just as operational management but as a strategic function central to business continuity and corporate responsibility.

Key Components of SCM: A typical supply chain encompasses several components or functional areas:

- Sourcing & Procurement: The process of finding suppliers, negotiating contracts, and acquiring raw materials, components, or services. This includes make-or-buy decisions, supplier relationship management, and purchasing transactions. Effective procurement ensures quality inputs at a reasonable cost and on-time supply.

- Production (Manufacturing or Operations): The conversion of inputs into finished products. This involves production scheduling, managing work-in-process inventory, quality control, and maintenance of facilities. Decisions here include what to produce in-house vs outsource, production batch sizes, and capacity planning.

- Distribution & Logistics: This covers warehousing, inventory management, and transportation of goods. Inbound logistics brings materials into a firm (for example, receiving goods from suppliers and storing them), and outbound logistics distributes finished goods to customers. Warehousing involves managing storage locations, stock levels, order picking and packing. Transportation decisions involve mode selection (air, sea, truck, rail), carrier management, routing, and delivery scheduling.

- Demand Management: On the downstream side, SCM also involves forecasting customer demand, managing order fulfillment, and customer service. Sales and Operations Planning (S&OP) is a common process to align demand forecasts with production and supply plans.

- Return Management: Often called Reverse Logistics, handling returns, exchanges, repairs, or recycling of products. This component has grown with e-commerce (higher return rates) and environmental emphasis (product end-of-life take-back programs).

- Enabling Processes: These include all supporting elements like IT systems (ERP, supply chain planning software), human resources (training supply chain staff), and performance management (metrics and continuous improvement initiatives like Lean/Six Sigma projects in the supply chain).

Objectives of SCM: The overarching goals that supply chain managers pursue include:

- Cost Reduction: Minimizing total supply chain costs. This isn’t just about cheap materials – it’s about total cost of ownership. For example, buying from a distant low-cost supplier may reduce unit price but increase transportation and inventory costs. SCM seeks the optimal balance.

- Customer Service: Ensuring product availability and timely delivery to meet customer expectations. Key measures are fill rate (percentage of customer orders fulfilled immediately from stock) and on-time delivery. High service levels can drive revenue and market share.

- Efficiency (Asset Utilization): Using resources like inventory, equipment, and labor efficiently. Metrics like inventory turnover (how many times inventory cycles per year) or capacity utilization rate gauge this. The Lean philosophy focuses on cutting out any non-value-added activities (waste) to improve efficiency.

- Responsiveness: The ability to respond quickly to changes in demand or supply conditions. In volatile markets, being agile – e.g. ramping production up or down rapidly, reallocating stock to where it’s needed – is vital. This often requires some slack or buffers (extra capacity or inventory) and flexible processes.

- Quality and Compliance: Delivering products that meet quality specifications consistently. Also ensuring compliance with regulations (e.g. food traceability, pharma lot control, export/import regulations). Quality issues in the supply chain (like a supplier’s defect) can have rippling costs, so SCM puts emphasis on building quality assurance throughout.

- Sustainability: Increasingly, minimizing the environmental footprint (lower emissions, less waste) and ensuring ethical practices (no labor exploitation in the supply base, etc.) are formal objectives. Many companies now have sustainability KPIs for their supply chain, recognizing it as part of their brand value and compliance requirements.

The “service vs cost” trade-off is a fundamental tension in SCM. Highest service (keep lots of inventory, use fastest transport) often raises cost, whereas lowest cost (lean inventory, batch transportation) can hurt responsiveness. The art of SCM is to optimize these trade-offs, often segmenting strategy by product or customer importance (for instance, critical high-margin products might get a “responsive” supply chain design with more buffers, while commodity products get a “lean” low-cost design).

In summary, Supply Chain Management is about holistic optimization and synchronization – making decisions that consider the entire chain’s impact rather than siloed outcomes. It requires collaboration across functions and organizations and relies heavily on information flow. This is why ERP systems and communication tools are so important: they enable the real-time sharing of demand data, inventory status, production schedules, and shipment tracking that underpins an integrated supply chain. The next sections will elaborate on specific models and strategies within SCM, and later we will circle back to how tools like ERPNext can support these complex requirements.

2. Supply Chain Models and Strategies

Organizations tailor their supply chain design to their business context by choosing appropriate models and strategies. Key strategic decisions include whether to operate a push-based or pull-based system, how lean or agile to make the supply chain, where to source from (global vs local), and whether to produce to stock or to order. We will discuss these in turn:

2.1 Push vs. Pull Supply Chains

In a push system, production and distribution decisions are driven by forecasts of future demand. Companies produce goods in anticipation of customer orders and “push” them downstream through the supply chain. For example, a fashion retailer might produce a large batch of winter coats in summer based on projected winter sales, then push inventory to stores. Advantages of push: it can create economies of scale in manufacturing and transportation (large batch production, full-truckload shipping) and ensures stock is on hand for customers (good service if forecasts are accurate). Disadvantages: if forecasts are off, it can lead to excess inventory or shortages (i.e. it’s inflexible to actual demand fluctuations). Push works well when demand is relatively stable and predictable, and product variety is low. The classic example is Henry Ford’s Model T production – a standardized product, produced in large volumes efficiently, with any color as long as it’s black. It minimized cost but offered no customization.

In a pull system, production and movement are triggered by actual customer demand rather than forecasts. The supply chain waits to “feel” the demand signal (e.g. a customer order) and then reacts to fulfill it, essentially letting customers “pull” products through the chain. Make-to-Order (MTO) is a pure pull approach – nothing is made until an order is in hand. A prime example was Dell Computers in the 1990s, assembling PCs only after an order was placed, allowing customization and avoiding excess inventory. Advantages: pull systems can respond directly to actual demand, thus avoiding overproduction and reducing inventory holding costs. They’re ideal for high customization or highly volatile demand situations. Disadvantages: they can have longer lead times for customers (since nothing is pre-made) and can suffer if the supply chain can’t react quickly enough (imagine raw material lead times preventing a quick assembly). Pull relies on fast information flow and flexible production to be effective.

In practice, many supply chains use a hybrid push-pull strategy. A common approach is push up to a certain point in the chain and pull from there on. For example, a company might push subassemblies or generic products down to regional distribution centers based on forecast (push), but final assembly or configuration is done in response to specific orders (pull). This is sometimes called a decoupling point or the point of postponement – where generic inventory (pushed) becomes customer-specific (pulled). This hybrid combines the efficiency of push (in earlier stages) with the customer responsiveness of pull (in later stages). An example is the manufacturing of paint: a factory produces base paint (white) in bulk (push), and stores it at distribution points; when a customer needs a specific color, tinting is done locally on demand (pull). Another hybrid example: a manufacturer might produce 80% of forecasted demand of an item to stock (push), but be ready to produce an extra 20% quickly if needed (pull for the surge).

Choosing the right push/pull balance depends on product characteristics and market conditions. If demand is very unpredictable or customization is valued, more pull is favored. If economies of scale are critical and demand is steady, push is fine. Modern techniques like demand-driven MRP (DDMRP) and Kanban systems are essentially pull-based mechanisms to manage replenishment based on actual consumption.

2.2 Lean vs. Agile Supply Chains

Lean and Agile are often presented as two ends of a spectrum in supply chain strategy. They relate to how the supply chain handles variability and what it optimizes for.

A Lean supply chain focuses on operational efficiency, cost reduction, and waste elimination. Lean thinking, derived from the Toyota Production System, identifies seven types of waste (excess inventory, waiting time, unnecessary transport, over-processing, etc.) and strives to eliminate them. Key attributes of lean:

- Just-in-Time (JIT) production: producing and delivering goods only as they are needed, thereby minimizing inventory. In a lean system, ideally each process produces only what the next process needs, when it needs it. This reduces holding costs and forces quick identification of problems (since any breakdown can stop the line).

- Continuous Improvement (Kaizen): lean supply chains continuously look for process improvements and cost reductions. Workers are empowered to suggest improvements, and techniques like Value Stream Mapping are used to analyze and streamline processes.

- Standardization and Stability: Lean works best with stable, predictable demand and a relatively stable product design. Long production runs of standardized products gain efficiency. The lean approach likes high equipment utilization and minimal changeovers (since changeovers introduce downtime waste).

- Low Buffers: Lean systems keep safety stocks low (or use none at all), and generally have suppliers deliver in small lot sizes frequently. This can increase supply risk if not carefully managed, but it forces issues to surface (e.g., if a supplier has quality issues, you catch it quickly because you didn’t stockpile months of inventory).

The benefits of lean include dramatically lower working capital (less money tied in inventory), lower operating costs, and often higher quality and process discipline (because problems can’t be hidden under piles of inventory). Toyota’s lean supply chain, with JIT and close supplier integration, allowed it to be very cost-competitive and high-quality for decades. However, lean’s weakness is revealed when unexpected disruptions occur. With minimal buffers, a lean supply chain is more vulnerable to shocks – a machine breakdown or a supplier delay can quickly stop production if there is no inventory cushion. Lean is best suited for stable, high-volume products (e.g. auto parts for a high-volume car, consumer staples) where demand variability is low and reliability is high.

An Agile supply chain prioritizes flexibility and responsiveness to rapidly changing demand or product mix. The agile concept emerged from the need to serve markets where demand is unpredictable (volatile volumes, variety, short product lifecycles like fashion or tech). Key attributes of agile:

- Excess Capacity or Inventory Buffers: Agile systems deliberately maintain some slack so they can respond to surges. For instance, an agile approach might keep more safety stock or reserve production capacity to accommodate rush orders. This increases cost but ensures capability to meet unexpected demand.

- Quick Changeovers and Small Batches: Agile manufacturing emphasizes being able to switch production from one product to another rapidly (e.g. quick die changes in factories). Smaller batch production means the supply chain can pivot to new products or designs with minimal finished goods obsolescence.

- Decentralized Decision-Making: Agile supply chains often push decision-making down and out – meaning local teams or supply chain partners can react without waiting for central approval, because speed matters. For example, a regional distribution center might have authority to expedite a special delivery for a key customer without bureaucratic delay.

- Market Sensitive and Information Driven: Agile chains use real-time data (such as point-of-sale information, social media trends, etc.) to detect changes in demand as early as possible. They may use advanced forecasting (sometimes called demand sensing) or even tie into customers’ systems for visibility. Collaboration with customers is common to adjust to demand (e.g. a retailer and manufacturer collaboratively manage inventory, with the manufacturer quickly replenishing items that are selling fast).

The benefits of agile include higher service levels in unpredictable markets – it’s better at “catching the wave” of a trend or meeting a sudden spike. It reduces stockouts for hot items and avoids large overstocks of slow-moving ones (because production waits until trends are clearer, or inventory is more buffered and repositionable). The costs of agile are typically higher operating costs: more inventory sitting around (or higher capacity costs), less economy of scale, and often more complex coordination. Agile supply chains can also be harder to manage because they rely on fast flows of info and materials – it’s like comparing a nimble speedboat (agile) to a steady freighter (lean); the speedboat can turn quickly but requires skilled piloting and more fuel per mile.

Lean vs Agile in practice: Many companies segment their product portfolio into lean and agile flows. A famous approach is “leagile” – lean for base demand, agile for surge demand. For example, a company might run a lean replenishment for predictable base sales of an item, but have an agile capability (like an express production line or expedited shipping option) for demand above forecast or custom orders. Another approach: by product type – functional products (staples with stable demand) use lean, innovative products (fashion, tech gadgets) use agile. Christopher and Towill (SCM scholars) suggested aligning strategy with product characteristics in this way.

Case examples:

- Lean: Toyota is classic lean – minimal inventory on assembly lines, suppliers delivering frequently in small lots; also Walmart in its supply chain for staple products, focusing on cost efficiency and turning inventory rapidly through its cross-docking distribution system.

- Agile: Zara (fast fashion) is a textbook agile supply chain. Zara produces fashion items in very short cycles, keeps initial production runs small, and then rapidly reacts to sales by making more of winners. It sources a good portion of production close to its market (in Europe) despite higher cost, so that lead times are only a few weeks. This agility allows Zara to match supply to the latest fashion trends quickly. As a result, Zara achieves high sell-through with minimal markdowns, offsetting the higher manufacturing cost.

It’s worth noting that agility also relates to resilience – a flexible supply chain can better handle disruptions (an agile network can reroute sourcing or logistics faster). Post-COVID, many traditionally lean-oriented companies are injecting more agility (or redundancy), effectively making a strategic shift from pure cost efficiency to balanced efficiency-resilience.

2.3 Global vs. Local Sourcing Strategies

Where to source or produce – globally or locally – is a critical strategic decision. In recent decades, global sourcing became prevalent as companies sought low-cost labor and materials worldwide, forming extensive international supply chains. The advantages of global sourcing include lower production costs (e.g. manufacturing in Asia, Eastern Europe, or Mexico for cost savings), access to unique skills or materials not available domestically, and the ability to serve foreign markets by producing there (avoiding tariffs and shipping costs). However, global supply chains come with longer lead times, higher transport costs, exposure to exchange rates and geopolitical risks, and complexity in coordination (time zones, language, cultural differences).

Local (or regional) sourcing, on the other hand, focuses on procuring from nearby suppliers or producing near the customer market. The benefits are shorter lead times, more control and visibility, often better quality communication (easier collaboration when nearby), and reduced transport emissions/costs. It can also be a marketing point (“locally made” appeal, or complying with local content regulations). The downside is often higher direct costs (labor or materials may be costlier locally) and limited availability of certain items (some electronics components, for example, might only be made in Asia).

Many companies adopt a hybrid sourcing strategy: keep sourcing of strategic, high-volume parts in low-cost countries for cost advantage, but for very time-sensitive or custom items, source locally. Or maintain a dual sourcing: a primary global supplier and a backup local supplier. This has been more common after recent disruptions – e.g., a company might source 80% of a part from China (cheaper) but 20% from a domestic supplier to keep them viable as a backup and to respond faster when needed.

“Nearshoring” and “reshoring” are trends under debate. Nearshoring means moving production closer to the end market (e.g. a U.S. company shifting production from Asia to Mexico or Latin America). Reshoring is bringing it back to the home country. Drivers for these moves include reducing supply chain risk, shortening supply lines (for agility or to respond to customers faster), and sometimes changes in relative costs (rising wages in traditional low-cost countries diminish the savings). For instance, after experiencing long delays and port congestions during COVID, some U.S. retailers started sourcing more from Central America instead of Asia to cut transit time. Similarly, Japanese firms have considered moving some sourcing out of a single country to spread risk.

Global vs local also ties to sustainability and resilience: Local sourcing can reduce carbon footprints due to less transport. It can also avoid certain ethical issues (like ensuring labor standards). However, global networks allow sourcing from places with renewable energy or abundant resources, which might be greener in production. The calculus isn’t straightforward and depends on specifics (for example, locally producing something in an inefficient factory could be worse than importing from a state-of-the-art efficient mega-factory abroad).

The choice can be dynamic: companies may shift the balance over time. E.g., a startup might source globally for cost, but as it grows and needs reliability, it sets up regional production. Or a company might globalize during stable times and localize after a shock (like how the 2011 Fukushima earthquake prompted some firms to reconsider single-country reliance for critical components, since that disaster disrupted global auto and electronics supply chains deeply).

In summary, global vs local is not either/or – most supply chains are a mix. The strategic approach often recommended is “produce globally, distribute locally” – meaning leverage global efficiencies in production or sourcing but then keep the distribution network close to customers for responsiveness. But if the product is bulky or customization is needed, producing locally might make sense to avoid logistics costs and delays. Tools like Total Cost of Ownership (TCO) models help quantify the trade-offs by including not just unit price but inventory in pipeline, transport, duties, risk costs, etc. We’ll later see how ERPNext can incorporate multi-currency and multi-location data that help make such decisions (for instance, analyzing landed cost of imports vs local purchases).

2.4 Make-to-Stock vs. Make-to-Order (and Configure-to-Order)

This aspect overlaps with push/pull but is worth detailing. Make-to-Stock (MTS) means producing goods in advance of demand and holding them as inventory (stock) until orders come in. Most consumer goods are MTS – the items on a store shelf or an e-commerce fulfillment center are made-to-stock, produced based on forecast. MTS provides immediate availability to customers (short lead time to deliver) at the cost of inventory investment and risk of unsold stock. It aligns with push and often lean strategies.

Make-to-Order (MTO) means waiting for an order before producing the item. This is necessary for highly customized products (like custom machinery, bespoke tailoring) but can also be a strategy to avoid inventory for expensive items. Customers are usually willing to wait (to some extent) for the item. The advantage is no finished goods inventory and the ability to offer variety/customization; the disadvantage is the customer lead time and potential for inefficient manufacturing if orders don’t align nicely. MTO is a pull approach and aligns more with agile strategy.

There are hybrid forms:

- Assemble-to-Order (ATO) or Configure-to-Order (CTO): Here, core components are made to stock, but final assembly or configuration is done after order. A classic example is Dell’s old model: keep components (like hard drives, motherboards, casings) in stock, but only assemble the specific combination when a customer order arrives. This yields relatively quick fulfillment (because assembly is quick) and still gives variety. Automotive industry uses a form of this – dealerships may not stock every variant of a car, but factories assemble to order with chosen options, albeit with some wait for the customer.

- Engineer-to-Order (ETO): an extreme of MTO where even the design is started after the order (for capital projects, unique machinery, construction).

From a supply chain view, companies often use different strategy per product line: for example, a company might MTS its standard high-volume products (to ensure they’re always in stock), but MTO special versions or less-demanded options. Decoupling point: This is the point in the supply chain where inventory is held as a buffer between the push and pull. In MTS, the decoupling point is finished goods at a warehouse; in ATO, it might be at semi-finished modules; in MTO, it might be raw materials. Managing that decoupling point is crucial – it’s where customer order penetrates.

Link to ERP: ERP systems like ERPNext allow setting an item as MTS or MTO. In ERPNext, one can mark whether an item will be produced only against a sales order or for stock. If set to MTO, ERPNext can automatically create a production job or purchase request when a sales order comes (thereby not allocating existing stock). If MTS, ERPNext will allocate from stock and trigger replenishment by forecast or reorder levels. Some companies do both – they keep some stock but also allow customization beyond stock via special orders.

Lean vs Agile vs MTS/MTO combined: Lean typically pairs with MTS (produce in advance in the most efficient way); Agile pairs with MTO/ATO (produce after knowing what is needed). However, even lean systems can have MTO for expensive slow movers, and agile systems might MTS generic parts.

A real-world example of mixing: HP’s printers in Europe: Historically they made many versions of printers for different countries (different power plugs, manuals, etc.) and used MTS for each country, which led to mismatches of stock. They famously changed to make a generic printer and postponed localization (packaging power cords and manuals) until orders by region came (ATO strategy). This significantly reduced overall inventory and improved flexibility.

Key takeaway: Supply chain strategy must align with product and market. Choosing push vs pull, lean vs agile, global vs local, MTS vs MTO are all strategic levers. Often, the answer is a segmented strategy: not one-size-fits-all, but tailoring the approach for different product segments or customer segments. For example, a company might have an “efficient supply chain” segment (lean, forecast-driven, global sourcing) for its commodity high-volume line, and an “responsive supply chain” segment (more agile, build-to-order, maybe local assembly) for its niche or high-end line. This segmentation is enabled by advanced planning systems and modular supply chain designs. In the next section, we will move from these high-level strategy choices to how supply chains are physically designed and optimized (network design, facility location, etc.).

3. Supply Chain Design and Network Optimization

Designing a supply chain network involves long-term decisions about the number, location, and capacity of facilities (factories, warehouses, distribution centers) and the flows between them (which plant supplies which warehouse, what routes trucks or ships take). These decisions have profound cost and service implications and are typically optimized using advanced analytical models. Key aspects include facility location planning, warehouse layout and design, and transportation network optimization.

3.1 Facility Location and Network Structure

Facility Location Problem: At its core, companies often face questions like – how many warehouses do we need and where should they be? Where should we build a new factory to serve a certain market? These are solved by optimizing trade-offs between transportation costs, facility operating costs, and service level (distance/time to customers). Classic models use mathematical optimization (linear programming, mixed-integer programming) to minimize total cost while satisfying service constraints. For example, a center-of-gravity model might compute a weighted center of customer locations to suggest a general area for a distribution center. More complex location-allocation models consider multiple facilities and assign customers to the nearest warehouse while factoring capacity.

Global Network Considerations: If operating globally, network design also needs to consider duty/tax implications (trade zones, import/export costs), supply base locations (you might put a factory near key suppliers to minimize inbound costs), and risk diversification (not putting all capacity in one region prone to a certain risk). Companies periodically redesign networks (every few years or when conditions change significantly, like after a merger or a new market expansion).

Examples: A company might analyze whether having 5 regional warehouses in the US is better than 2 large ones centrally located. More warehouses mean higher warehousing costs but lower delivery costs/time to regional customers. The optimal number balances these. Amazon famously continuously evolves its fulfillment center network to place inventory closer to population centers and offer same-day or next-day delivery at reasonable cost.

Service Level and Location: Some network optimizations include service level as constraints, e.g., 95% of customers must be within 2 days shipping time. This can push for more localized facilities. In Europe, due to country regulations, some firms keep one warehouse per country (to handle local returns easily and local language, etc.), but others consolidate to a few continental hubs for efficiency.

Use of Optimization Tools: Companies use specialized software (like anyLogistix, Llamasoft (Coupa), or CPLEX, Gurobi solvers for custom models) to run scenarios. These tools can handle multi-echelon networks and often also consider inventory cost vs location trade-offs (since more warehouses means each holds safety stock, raising total inventory).

From a cost perspective, an element is risk pooling: having fewer central warehouses can reduce total safety stock needed, because pooling demand variability across regions (this is a benefit of centralization – it’s a statistical phenomenon that variability dampens when aggregated). However, few warehouses increase outbound transport distances. So the model weighs inventory costs + warehousing costs + transport costs.

3.2 Warehouse Design and Layout

Once facility locations are decided, designing each facility optimally is another aspect (though more operational than strategic). Warehouse layout involves decisions on how to organize storage (racking systems, shelving), material handling equipment (conveyors, forklifts, robotics), and workflow (receiving docks location, picking paths). Good design can improve efficiency (faster picking, less congestion) and storage density.

Key warehouse concepts:

- Slotting: determining which products go in which locations in the warehouse. Fast-moving items are often placed near shipping area or in easy-to-reach locations (eye-level, for example) to reduce picking time. Heavy items at lower levels for safety, etc.

- Cross-docking: a practice where incoming goods are directly transferred to outbound trucks without long storage, used to speed flow and reduce inventory. Walmart and many retail DCs use cross-docking – suppliers’ shipments come in, get sorted, and quickly consolidated out to stores, often within 24 hours.

- Automation: As labor is a big cost, many warehouses use automation and robotics (conveyor systems, automated storage and retrieval systems (AS/RS), and more recently autonomous mobile robots (AMRs) for picking). As noted earlier, by 2027, the majority of companies may adopt some form of warehouse robotics[2]. This can drastically change layout (e.g., Kiva robots used by Amazon allow goods-to-person picking, which eliminates wide aisles – more dense storage and robots bring shelves to workers).

- Layout optimization: ensuring there is a logical flow – receiving to storage to picking to packing to shipping, with minimal backtracking. Many warehouses are divided into zones (by product type or order type) to improve specialization.

- Capacity and scalability: Designing for current volume but anticipating growth – e.g., space for future racks or expansion.

Although ERPNext is not a warehouse control system, it does maintain basics like bin locations and can produce picking lists to guide workers. It can be extended for WMS needs (some companies have added features for directed putaway or RF scanning integration). Ultimately, physical design choices will influence how the ERP is configured (for example, if a warehouse is zoned, the ERP might need to generate zone-based pick lists, etc.).

3.3 Transportation and Route Planning

Transportation optimization is another crucial aspect of supply chain design. This can happen on two levels: strategic (mode selection, carrier contracting) and operational (route planning, load optimization).

- Mode & Carrier Strategy: Deciding what modes to use (sea vs air vs rail vs truck, etc.). For global trade, usually a cost vs speed trade-off (air is faster but costly, ocean is cheap but slow). Many supply chains use a combination, e.g., primary plan by ocean, but use air freight for a portion if demand spikes or delays happen (expedited shipping). Also whether to use 3PLs (third-party logistics providers) or maintain a private fleet is a strategic choice. Many companies outsource a lot of transportation to specialists. Carrier selection and contracts can reduce cost; e.g., negotiating volume contracts with major trucking firms or ocean carriers.

- Route Planning: This refers to designing efficient routes for delivery vehicles – particularly relevant for distribution networks delivering to many stores or customers (think of a milk-run truck delivering to multiple retail stores). Algorithms like the Vehicle Routing Problem (VRP) solvers aim to find the shortest or cheapest set of routes to cover all delivery points given constraints (capacity of truck, time windows for deliveries, etc.). Good routing can save fuel and driver time. This is sometimes done via specialized software (TMS – Transportation Management Systems) that can take orders and output optimized routes.

- Consolidation: A strategy where shipments are held to combine into a larger load to get better transport rates (e.g., LTL vs FTL shipments – less-than-truckload is more costly per unit than full-truckload, so you consolidate orders to fill a truck). Or consolidating shipments going to similar regions. There is a trade-off between consolidation (which may introduce delay) and speed.

- Network routes: On a larger scale, companies also design transportation networks – like deciding on intermediate transit hubs, cross-docks, or milk-run circuits for supplier pickups. For instance, an automaker might have a route that a truck takes each day looping through several suppliers (milk run) to collect parts, rather than each supplier sending separate truck.

- Technology in transport: IoT and telematics allow real-time tracking of shipments and vehicles. Route planning can become dynamic (re-routing trucks in real time if traffic or a new high-priority delivery arises). AI can help optimize scheduling (some companies like UPS use AI to plan driver routes, famously minimizing left turns to reduce idle time).

Examples: UPS’s ORION system is a famous route optimization tool that reportedly saves millions of miles driven by optimizing driver routes. In maritime shipping, companies design networks of ocean lanes and use transshipment hubs to balance cost and flexibility.

Optimization models: From a modeling perspective, transportation problems are often solved with linear programming for load optimization (e.g., assignment of shipments to trucks or containers) and with more complex heuristics for routing (VRP is NP-hard, so often solved with metaheuristics or integer programming for small cases). Many ERP systems have basic logistics modules, but often companies integrate a dedicated TMS for detailed routing.

ERPNext’s core might not handle complex routing optimization internally (it allows setting shipping rules, but not doing an algorithmic optimization of multi-drop routes natively). However, data from ERPNext (orders, locations) could be exported to an optimization tool, and results (like planned routes or shipment plans) could be fed back. Or simpler, an ERPNext user could manually plan or use external tools and then record shipping data in ERPNext. There are community apps that integrate shipping APIs (for label printing, rate shopping). For example, connecting to EasyPost to get rates from UPS, FedEx, etc., which ERPNext can use to pick cheapest carrier and print labels.

Network Example for Risk: On network optimization, one interesting angle is optimizing not just for cost, but also for risk/sustainability. Some companies are now modeling CO₂ emissions per route to choose a greener network (even if slightly costlier) to meet sustainability goals. Others incorporate risk metrics: e.g., avoid having >X% of supply coming via a single port or shipping lane.

In summary, supply chain design is about creating a blueprint that meets service requirements at minimum cost. It’s a multi-factor problem requiring balancing inventory, facility, and transport costs. Quantitative optimization plays a big role, but so do qualitative factors (like local infrastructure quality, political stability, labor availability, etc., which are hard to model but critical in site selection). The output of network design decisions feeds into many operational decisions. Once you have certain warehouses, you then design replenishment strategies, inventory levels there (next section covers inventory specifically), and so on.

We have thus far discussed strategy and structure. With that foundation, we now delve into one of the most critical operational aspects: how to manage inventory in the supply chain to buffer against uncertainty while minimizing waste.

4. Inventory Management

Inventory is often the largest asset on a supply chain’s balance sheet and a key driver of responsiveness. It includes raw materials, work-in-process (WIP), and finished goods. Managing inventory is a delicate balancing act: too little inventory can lead to stockouts and lost sales or production halts; too much inventory ties up cash, incurs storage costs, and risks obsolescence (especially for perishable or short-lifecycle products).

This section covers foundational inventory concepts: Economic Order Quantity (EOQ), safety stock, Just-in-Time (JIT), the Bullwhip Effect, and demand forecasting techniques.

4.1 Economic Order Quantity (EOQ) and Replenishment

The Economic Order Quantity model addresses the question: “How much to order?” for a given item each time you replenish, in order to minimize total costs. Total cost has two main components:

- Order (or setup) costs: Costs that incur each time you place an order or produce a batch (e.g. paperwork, shipping, setup time for machines).

- Holding (inventory carrying) costs: Costs to hold inventory over time (capital cost, warehousing, insurance, spoilage, etc.).

EOQ provides a formula for the optimal order quantity Q* that minimizes the sum of ordering and holding costs per period. The classic formula (Wilson formula) is:

EOQ=2DSHEOQ = \sqrt{\frac{2DS}{H}}EOQ=H2DS

where D is annual demand, S is order cost per order, and H is holding cost per unit per year. The formula balances the trade-off: ordering in larger batches reduces the number of orders (saving order costs) but increases average inventory (raising holding cost), and vice versa. The EOQ point is where these cost rates equalize.

For example, if a shop sells 1,000 units a year, the cost to place an order is $50, and holding cost per unit per year is $2, EOQ = sqrt(2100050/2) = sqrt(50,000) ≈ 224 units. So ordering 224 units each time (about 4–5 orders a year) minimizes cost in that simple model. If they ordered more at once, holding cost would outweigh ordering cost saved; if they ordered less at a time, ordering cost would dominate.

Assumptions of EOQ: stable demand, constant lead time, no quantity discounts (though there are versions adjusting for that), and ignoring stockout costs. Despite its simplicity, EOQ is widely used as a benchmark. Many ERP systems, including ERPNext, allow setting a fixed order quantity or use reorder point logic which can incorporate EOQ thinking when configuring reorder levels.

Reorder Point (ROP): This is the trigger level of inventory at which a new order should be placed. For example, if lead time is 2 weeks and weekly demand is 50, one might set ROP = 100 units (so that when inventory drops to 100, you order EOQ and by the time it arrives you haven’t run out). Safety stock is often added to the ROP to buffer against variability (more on safety stock next). ERPNext supports setting Reorder Level and Reorder Quantity for items at each warehouse. When stock Projected Qty falls below the level, it can auto-create a material request or purchase order for the specified quantity (which could be EOQ). This is essentially implementing an order-point, order-quantity policy (also known as a continuous review policy).

Periodic vs Continuous Review: Some companies check inventory continuously (via system transactions) and reorder as soon as ROP is hit (continuous review). Others check at fixed intervals (say every Monday, or monthly) and then decide how much to order to top up (periodic review). Periodic can align with cycles but might require larger safety stocks as you could run low just after a review and not order until next cycle. ERPNext can do periodic ordering via Material Request planning or using the Auto Reorder feature that can run periodically.

4.2 Safety Stock and Service Levels

Safety stock is the extra inventory held beyond expected demand to protect against uncertainties. Uncertainties include demand variability (sales could be higher than forecast in a period) and supply variability (supplier delays, transport disruptions). The goal of safety stock is to prevent stockouts within a desired service level.

For example, if you promise 95% service (no stockout 95% of the time during lead time), you would calculate safety stock such that the probability of not running out is 95%. Statistically, if demand during lead time is normally distributed with mean μ and standard deviation σ, safety stock could be set as z×σLTz \times \sigma_{LT}z×σLT where z is the safety factor corresponding to the desired service level (z≈1.65 for 95%). This is a classic formula taught in supply chain courses. In practice, companies might use simpler rules of thumb or more advanced simulations depending on criticality.

ERP systems can assist by tracking lead time and demand variability data to recommend safety stock. Some advanced planning tools have algorithms for this. In ERPNext, one would manually set safety stock in the Item or include it in reorder level calculations (there isn’t an automatic safety stock calc built-in by default, but one could use custom scripts or an app to compute it).

Service Level vs Fill Rate: There are nuances – a 95% cycle service level (probability not stockout in a period) might correspond to a higher fill rate (percentage of demand fulfilled, since even if stockout happens, it might be partial). Companies choose metrics that matter: if avoiding any stockout is key, service level metric is used; if measuring quantity short, fill rate is used.

Costs of safety stock: It ties up capital and increases carrying cost. But the cost of stockouts might be lost sales or expediting costs, which can justify safety stock. So finding the optimal safety stock is essentially balancing service level benefit vs inventory cost. There’s a formula using a newsvendor model for perishable or one-time stock (balance stockout cost vs holding cost to find optimal service level). For ongoing stock, often companies pick a target service (like 98% for important products, 90% for less important) based on business strategy and then calculate needed safety stock.

Factors increasing needed safety stock: longer lead times (more uncertainty period to cover), higher demand variability, unreliable suppliers, poor forecast accuracy, and desired high service. Reducing lead times or improving forecast will reduce the safety stock requirement.

From a strategic perspective, some firms in the pandemic re-evaluated their safety stock levels. Just-in-Time (JIT) advocates minimal to zero safety stock, relying on process stability. But COVID taught that some additional buffer for critical items is prudent. Many are now carrying more safety stock for certain components (especially those with long overseas pipelines, like chips or specialized raw materials). This is a shift in mindset from pure lean to more resilience.

4.3 Just-in-Time (JIT) and Inventory Reduction

JIT was mentioned earlier under lean – it’s essentially a philosophy of zero (or minimal) inventory by timing deliveries and production exactly when needed. Benefits: if successfully implemented, inventory holding is near zero outside of what’s in process, which saves money and forces very tight quality and schedule discipline (problems surface immediately). JIT often involves Kanban signals – e.g., a simple card or electronic signal that triggers replenishment when a bin is empty. The supplier or upstream process then quickly refills that bin.

Requirements for JIT: Very reliable suppliers, short lead times, often proximity (Toyota famously clusters suppliers near its plants to facilitate JIT deliveries multiple times a day). JIT can be risky if any link breaks – as happened to some companies when a single JIT supplier had a fire and they had no stock to keep running (e.g., the 1997 Aisin fire in Toyota’s brake supplier halted Toyota for days).

Many companies use a mixed approach: JIT for stable high-runners where supply is reliable, but keep safety stock for riskier items.

Inventory turnover is a metric to gauge how well inventory is managed. It’s cost of goods sold divided by average inventory cost. Lean JIT companies have very high turns (20+ per year is very high; some companies operate at 50 or 100 turns for extremely fast-moving goods). Others might have 5 or fewer (meaning they hold lots of inventory relative to sales).

One should also consider different types of inventory:

- Cycle stock: inventory that is intended to be used to satisfy demand between replenishments (the “working stock”).

- Safety stock: as above, buffer.

- Pipeline inventory: inventory that is currently being shipped or in transit in the network (particularly relevant for long supply lines – if it takes 8 weeks to ship from overseas, you’ll always have 8 weeks of demand worth “on the water”).

- Pre-build or seasonal stock: some businesses with seasonality build inventory in advance of peak season (e.g., toy manufacturers build up in summer for holiday season) – it’s a conscious inventory that will be depleted after the season.

- Obsolete/dead stock: inventory that is not expected to sell (either excess or outdated) – needs to be scrapped or sold at discount. Good inventory management tries to minimize reaching this stage through better forecasting and lifecycle management.

4.4 The Bullwhip Effect Revisited

The Bullwhip Effect is a well-known phenomenon first documented in supply chain literature in the 1990s. It refers to the observation that order variability in a supply chain is amplified as you move upstream (away from the customer). In other words, consumer sales might fluctuate mildly, but each tier in the supply chain tends to overreact: a retailer sees a slight uptick and orders more in proportion, the distributor sees the bigger order swings and further amplifies their orders to producers, and so on, like a cracking bullwhip.

Causes of bullwhip[1][1]: Several causes were identified:

- Demand Signal Processing: Lack of visibility to true end demand causes each tier to forecast demand based on the orders it receives, which may already include some noise or batching. If retailers don’t share actual sales data, upstream only sees orders which could misrepresent real consumption.

- Order Batching: If customers (like retailers) batch their orders (e.g. order only once a month to save freight), then from the supplier perspective, demand appears lumpy (zero for weeks, then a big spike). Upstream, that might prompt larger, less frequent production, further increasing variability[1][1].

- Price Fluctuations and Promotions: If there are sales promotions, forward-buying occurs (customers buy more than needed now to benefit from low price, then buy less later). This creates artificial peaks and troughs. e.g., a wholesaler offers discount at quarter-end, retailers load up; next month they order little. Upstream sees wild swings.

- Shortage Gaming: If items are scarce and on allocation, customers might exaggerate orders to try to get more (gaming the allocation system). When supply catches up, they cancel orders, causing distortions.

- Long Lead Times: The longer the lead time, the more safety stock and batch sizes companies use, which increases bullwhip. Also, with long lead times, outdated forecasts are in the pipeline and by the time they arrive, demand changed, causing over/under shoot.

- Poor Communication: Misaligned objectives or siloed planning where each tier independently plans without collaboration can exacerbate bullwhip[1][1].

Effects of bullwhip: It leads to excess inventory (when the amplified orders overshoot real demand), stockouts (in the oscillations, sometimes inventory is under-ordered then demand can’t be met), inefficient production (capacity has to scale up and down with erratic orders), and higher costs (expediting, overtime, etc.). P&G’s observation of diaper sales is a classic example: babies consumed at steady rate, retail sales had some fluctuation but distributors’ orders to P&G had much bigger swings, and P&G’s orders to their suppliers (like material suppliers) swung even more. This resulted in inefficiencies and costs that, in the end, make the whole chain less profitable and less responsive.

Preventing/Mitigating Bullwhip[1][1]:

- Information Sharing: If downstream sales data is shared upstream (e.g., via electronic data interchange (EDI) or collaborative systems), upstream can forecast based on actual consumer demand, not just orders. This is part of CPFR (Collaborative Planning, Forecasting, and Replenishment) processes. Many retailers share POS data with suppliers or use vendor-managed inventory (VMI) arrangements where the supplier monitors retail sales and replenishes accordingly. P&G, for instance, started receiving Walmart’s sales data to align production (this was part of the Efficient Consumer Response initiative).

- Smaller Batch / Higher Frequency Orders: Encouraging more frequent, smaller replenishments smooths the flow. This can be facilitated by lower order costs (maybe through e-commerce systems) or logistics solutions (3PLs consolidating multiple small shipments). Essentially, if it’s easy and not costly to order weekly instead of monthly, retailers will do so.

- Stabilize Pricing: Use Everyday Low Pricing (EDLP) rather than big promos to avoid forward buying swings. Many CPG companies and retailers moved to EDLP to reduce distortions in demand. If promotions are used, better to coordinate them across the chain or use them in ways that don’t disrupt ordering patterns severely.

- Allocate based on past sales in shortages: To avoid gaming, if a shortage occurs, allocate supply to customers in proportion to their normal demand (not the inflated orders). That way they know there’s no benefit to exaggeration.

- Lead Time Reduction: By reducing lead times (through closer warehouses, faster manufacturing, etc.), you shrink the delay in the system, which reduces oscillation amplitude (in control theory terms, a shorter lag mitigates bullwhip). If something changes, you aren’t already committed to huge orders in pipeline; you can adjust faster.

- Order Smoothing and Visibility: Some companies impose maximum order variability or will collaborate with partners to adjust orders. For example, an upstream might say “if you dramatically increase order, please provide rationale or schedule it out.”

Role of ERP and IT: Modern ERP and supply chain systems help a lot here by providing more visibility. If each tier can see the others’ inventory and plans, they can coordinate. Tools like demand planning modules can take actual consumption data (from downstream ERPNext systems, perhaps) and propagate that upstream. ERPNext itself could be part of this if multiple tiers all used ERPNext and opted into data sharing or a central hub (a concept we discuss later: the potential for an ERPNext-based network). Even without that, using ERPNext’s sales forecasting and material request planning, a company can try to align its production with actual sales rather than just reacting to spikes in orders from intermediaries.

In sum, inventory management needs to ensure the right buffers in the right places. There’s a saying: “Inventory is both an asset and a liability”. Too little and you lose sales; too much and you tie up cash and might have to write-off obsolete stock. Best-in-class supply chains use segmentation (different inventory strategy for different products: e.g., critical parts get more safety stock, cheap bulky items maybe kept lean), advanced forecasting (using statistical models, AI to predict demand better), and continuous improvement techniques to reduce the need for inventory (like shortening lead times, improving on-time performance, so safety stocks can be lowered). Next, let’s examine the critical upstream aspect – managing suppliers – because how one handles supplier relationships greatly impacts inventory (supplier reliability affects needed safety stock) and overall supply chain performance.

5. Supplier Relationship Management (SRM)

Suppliers provide the inputs that keep the supply chain running, making SRM a strategic component of SCM. Supplier Relationship Management involves systematically managing and improving interactions with the third-party vendors that supply goods or services to an organization. It spans vendor selection, segmentation, performance measurement, risk management, and collaboration. The ultimate aim is to ensure a reliable, cost-effective, and high-quality supply base, and increasingly, one that aligns with the buyer’s values and standards (e.g. sustainability, social responsibility).

5.1 Vendor Selection and Qualification

Choosing the right suppliers is the first step. Organizations typically define criteria and a process for supplier selection:

- Criteria: Cost/price competitiveness, quality standards, delivery reliability, technical capability, capacity available, financial stability, location/proximity, compliance (certifications like ISO9001 quality, ISO14001 environmental, etc.), and more recently, criteria like cyber-security posture (for digital suppliers) or ESG ratings.